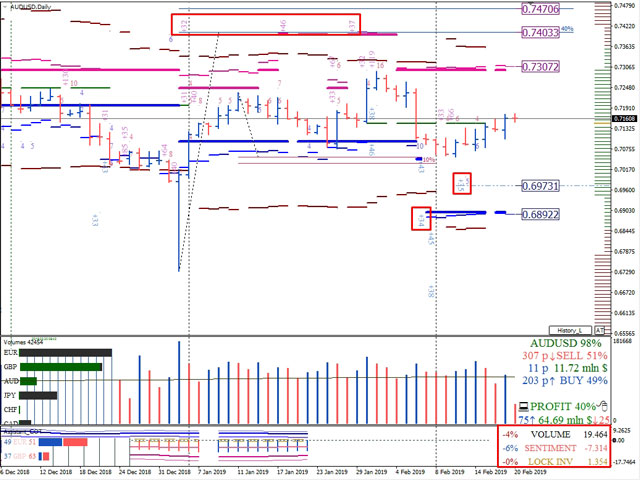

The market owners’ cash investments in derivatives on the Australian dollar by CME Group exchanges amounted to $ 19 billion 464 million. The capitalization of investments decreased by 4%.

The net advantage of bearish positions decreased by 6%. Total net sellers AUDUSD in monetary terms amounted to $ 7 billion 314 million.

The decrease in the locked positions of investors was less than 1%.

The total investment ratio of SMART MONEY in AUD / USD is as follows: 31% of buyers and 69% of sellers.

The first goal of the increase on the daily timeframe is the premium level of the monthly hedger resistance zone (0.7307).

The next important resistance is the long-term region of 40% of buyers (0.7403-0.7470).

The closest support level for trading within the current option month is the option level of growth of $ 35 million for growth on monthly contracts (0.6973).

Subsequent support is the monthly support level of hedgers 0.6892.

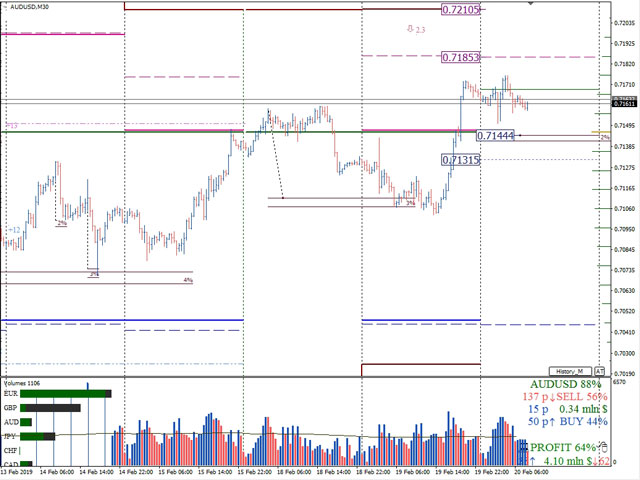

The closest key support level for today is the weekly market maker balance (0.7150).

The next level of support for Wednesday, February 20, is the level of the highest paid commission for weekly put contracts (0.7131).

The first growth target for the current working day is the premium of the weekly hedger resistance zone (0.7185).

The ultimate goal of growth for the current trading week is the level of the beginning of the market maker loss (0.7210).

Dmitry Zeland, analyst at a brokerage company MTrading.