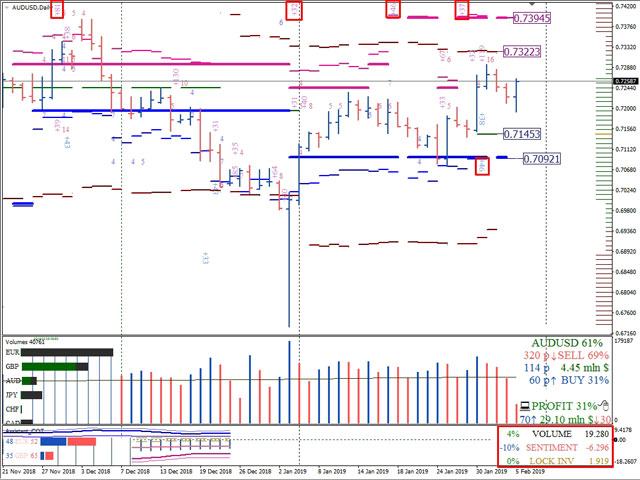

The total capitalization of investments in derivatives in the Australian dollar amounted to $ 19 billion 280 million. The increase in capitalization was 10%.

The balance of bear positions in monetary terms amounted to $ 6 billion 296 million. The decrease in the prevalence of bears was 10%.

The increase in the locked positions of investors at the same time was less than 1%.

The total cash investment in AUD / USD unequivocally indicates that the bears are overweight: 34% of buyers and 66% of sellers.

The closest important resistance level on the daily timeframe is the monthly market maker resistance level at 0.7322.

The next target of the increase is the historical option level of the growth of positions for a decline in the total amount of $ 196 million (0.7394).

The nearest long-term support level is the monthly market maker balance (0.7145).

The next support is the strike of the monthly hedger support zone (0.7092).

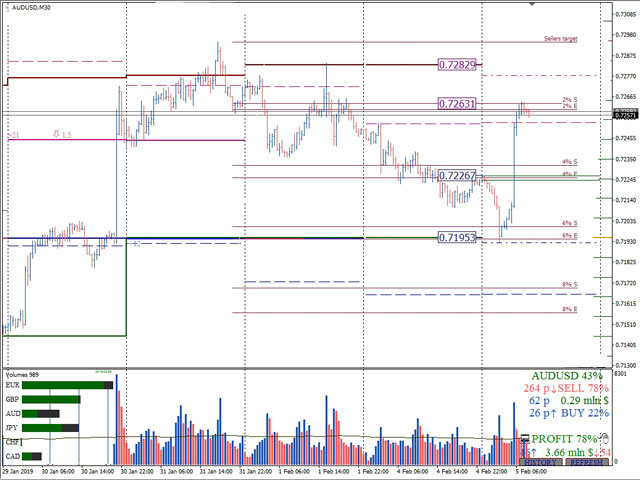

The key area for trade on Tuesday, February 5, is the zone of 2% of sellers (0.7263-0.7257).

The immediate goal of growth is the weekly resistance level of the market maker 0.7282.

The target point of decline is the optional day balance (0.7226).

The next guideline of resistance in intraday trading is the weekly market maker balance (0.7195).

Dmitry Zeland, analyst at a brokerage company MTrading.