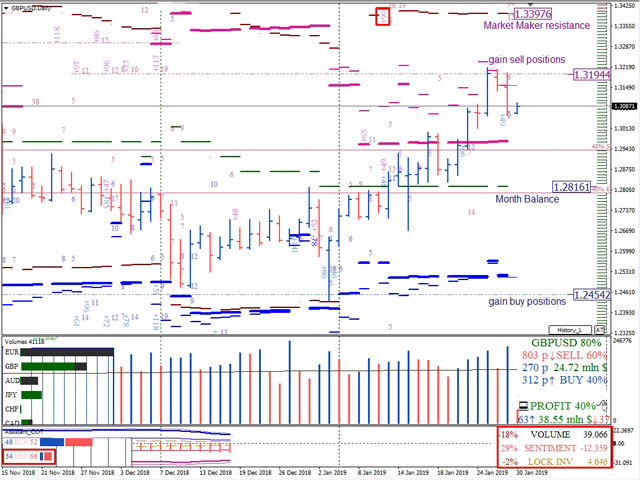

The market owners ’cash investments in derivatives on the British pound of the CME Group Exchange amounted to $ 39 billion 66 million. The capitalization of investments decreased by 18%.

The total net overweight of GBPUSD sellers in cash amounted to $ 12 billion 359 million.

The decrease in the locked positions of investors was 2%.

It should not be forgotten that the total investment ratio of SMART MONEY in GBP / USD is as follows: 34% of buyers and 66% of sellers.

The first goal of the increase on the daily timeframe is the historical option level of the growth of positions for decline (1.3194).

The next important resistance is the monthly option level of the beginning of the market maker’s loss at a quotation of 1.3397, on which is the addition of bearish long-term positions totaling $ 90 million.

The closest support level for trading inside the current option month is the monthly market maker balance (1.2816).

Subsequent support is the monthly option level of growth of positions on growth at the quotation 1.2454.

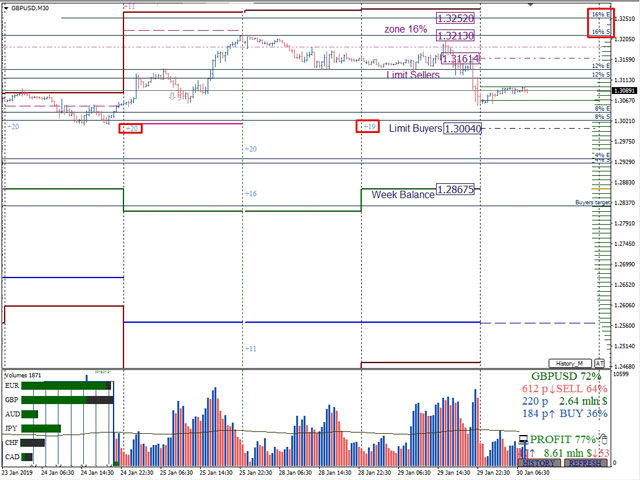

When considering the likely speculative decisions of the current trading day, it is worth noting the closest key support level, the level of limit buyers (1.3004).

The next level of support for Wednesday, January 30, is the weekly balance of the option seller (1.2867).

The first growth target for the current working day is the level of limit sellers (1.3161).

In case of breakdown and consolidation above the indicated resistance level during the European or American session of the current working day, the probability of a subsequent increase to the final growth target for the current trading week, to the zone of 16% of buyers (1.3213-1.3252), increases.

A detailed analytical review of the major currency pairs of the Forex market, Bitcoin and Ethereum cryptocurrencies, WTI crude oil, gold index, and S&P500 stock index is further on YouTube channel.

Dmitry Zeland, analyst at a brokerage company MTrading.