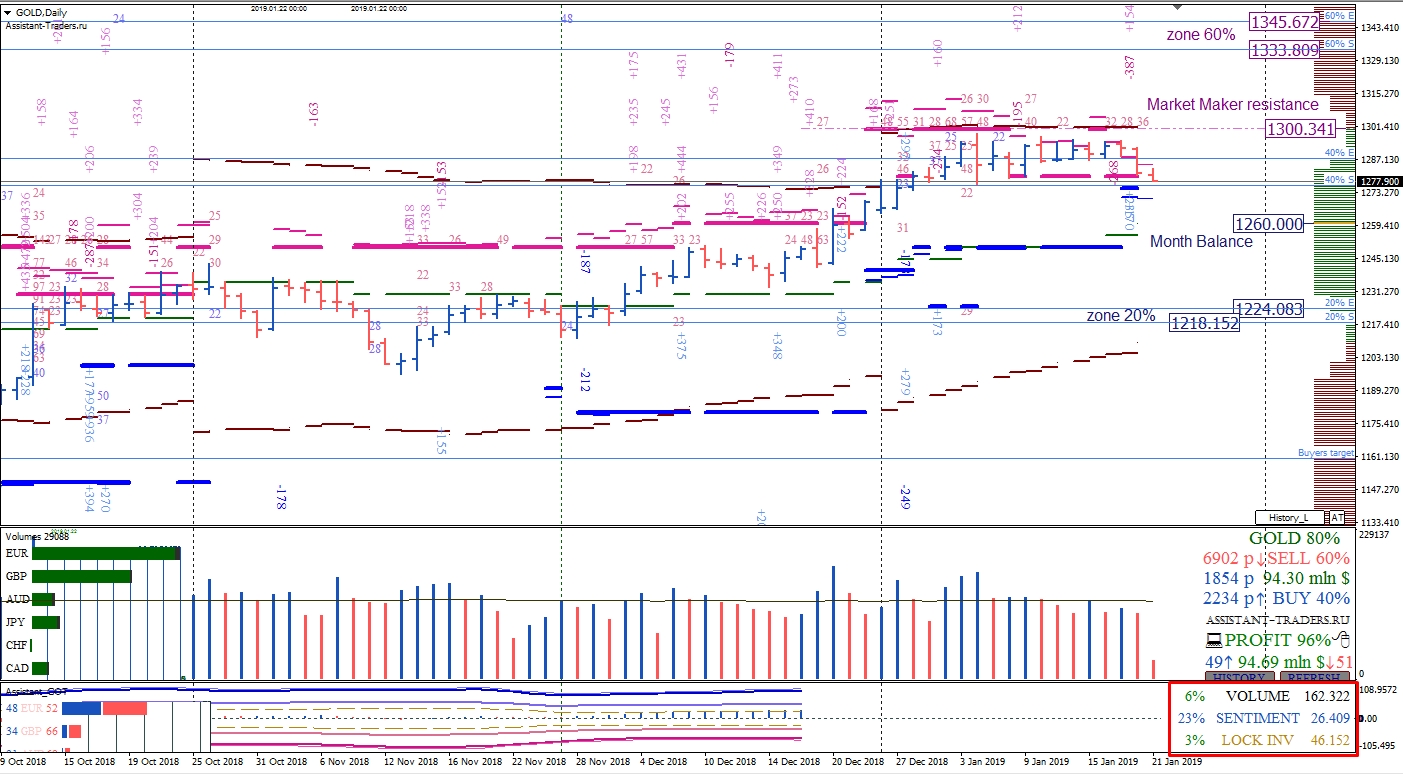

Total cash investments among major participants of the CME Group on gold derivatives trading increased by 6%.

At the same time, the total capitalization of investments in dollars amounted to $ 162 billion 322 million.

The predominance of bulls increased by 23%. In monetary terms, the overriding customer sentiment amounted to $ 26 billion 409 million.

The number of locked positions of investors increased by 3%.

The following money is invested in XAU/USD among SMART MONEY: 58% of buyers and 42% of sellers.

The first long-term goal of raising on the daily timeframe is the monthly market maker resistance level (1300.34).

The next resistance is the zone of 60% of buyers (1333.80-1345.67).

The closest key support level for doing business within a month is the monthly balance of the market maker 1260.00.

The next long-term goal of reduction is the zone of 20% of buyers (1224.08-1218.15).

The key support area for the first working day of the current week is the zone of 4% of sellers (1280.00-1278.33).

In case of a breakdown of the zone of 4% of sellers, a decline to the weekly level of market maker support (1269.60) can be expected.

The closest resistance level on Monday, January 21, is the weekly market maker balance (1290.00).

The next goal of growth within the working week is the option balance of the day (1.3350).

A detailed analytical review of the major currency pairs of the Forex market, Bitcoin and Ethereum cryptocurrencies, WTI crude oil, gold index, and S&P500 stock index is further on YouTube channel.

Dmitry Zeland, analyst at a brokerage company MTrading.