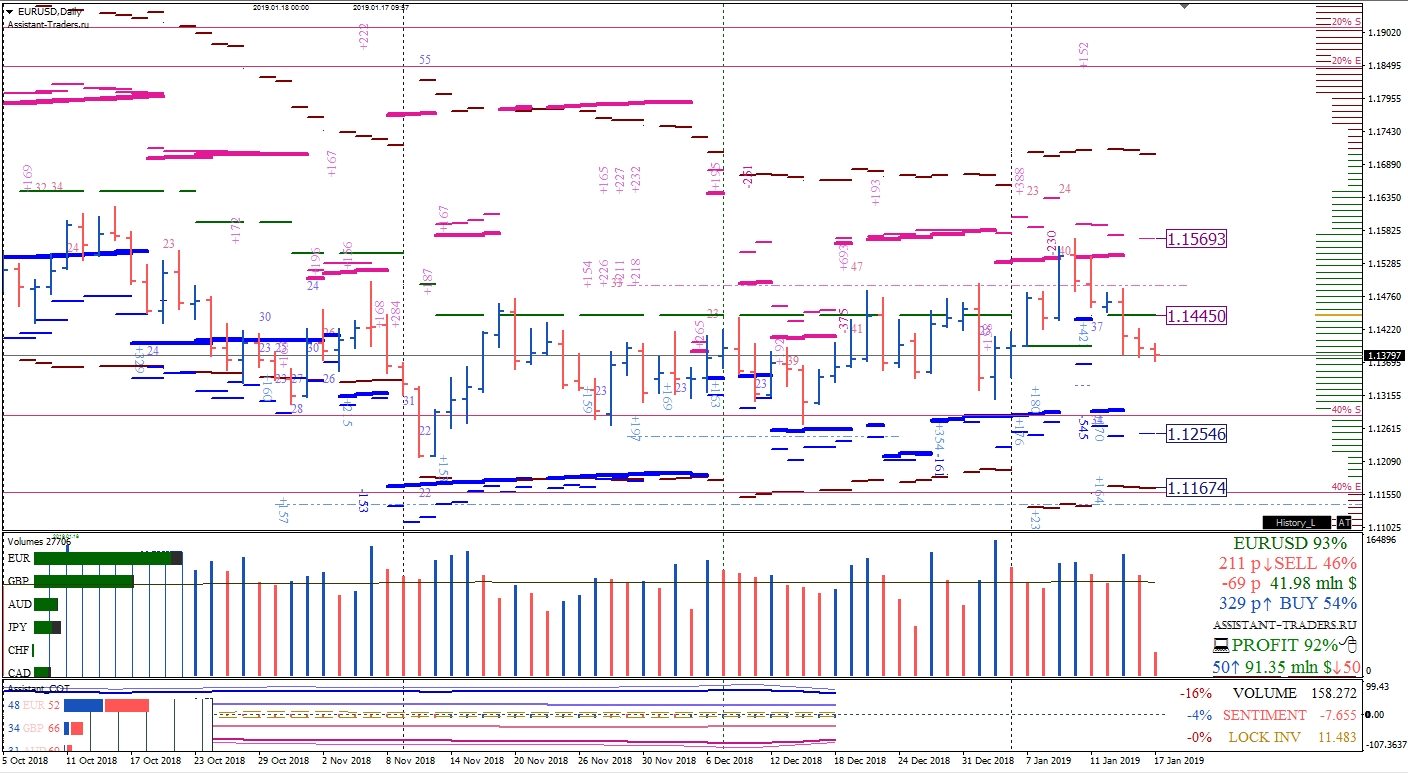

The capitalization of positions of CME Group participants reporting to CFTC on euro derivatives decreased by 16%. The total capitalization of derivatives markets for the euro reached $ 158 billion 272 million.

The margin of bearish positions at the same time decreased by 4%. In cash, the seller’s advantage was $ 7 billion 655 million.

Investors have reduced the number of blocked positions by less than 1%.

Also worth noting is the following ratio of capital investments in derivatives on USOIL among SMART MONEY: 48% of buyers and 52% of sellers.

The nearest long-term support on the daily timeframe is the level of premium support for hedgers (1.1254).

The subsequent support on the daily timeframe is the level of loss of the market maker (1.1167).

The closest resistance on the daily timeframe is the monthly market maker balance (1.1445).

The next growth target in trading inside the current option month is the premium of the monthly hedging resistance zone (1.1569).

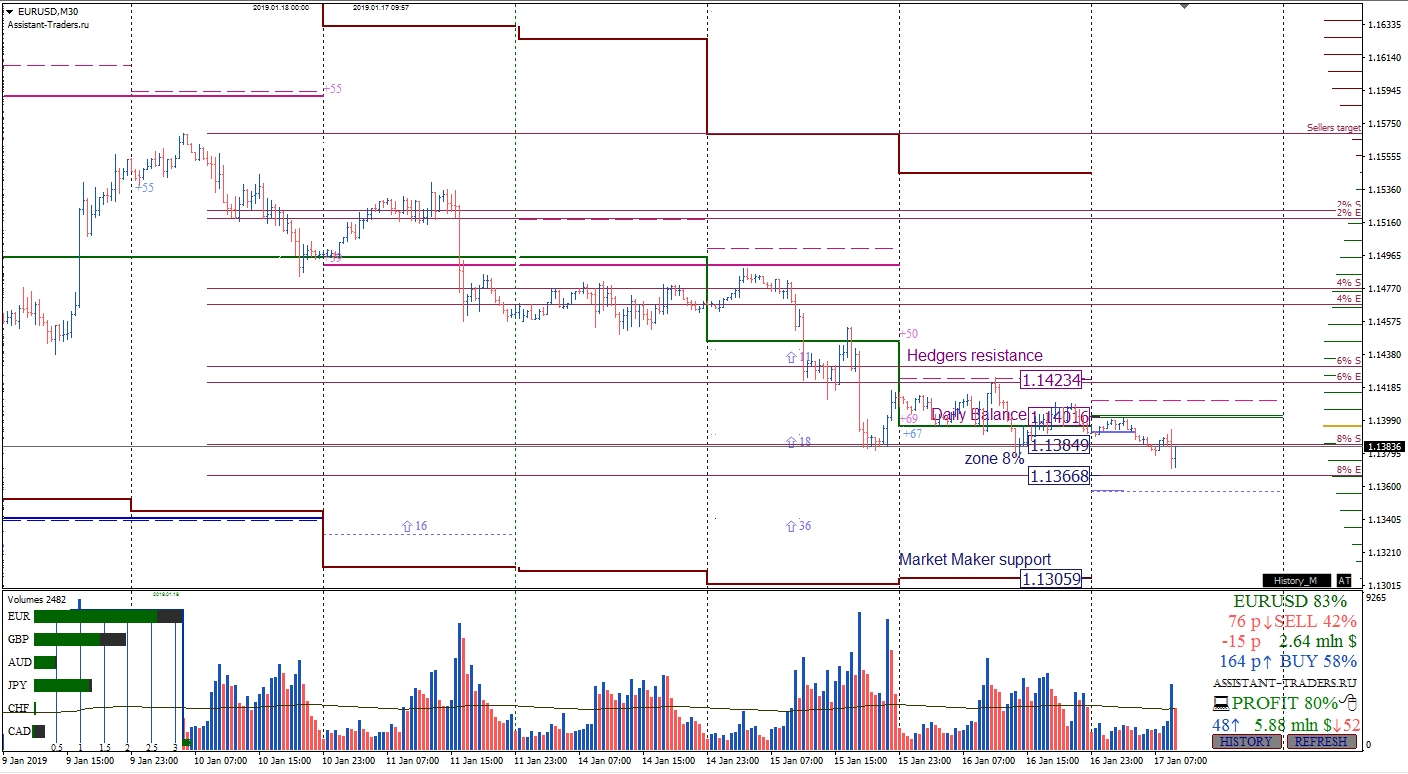

The nearest area of support today is the zone of 8% of sellers (1.1384-1.1366).

Subsequent support is the weekly market maker support level (1.1305).

The closest resistance in intraday trading is the option balance of the day (1.1401).

The subsequent resistance is the premium of the hedge resistance zone (1.1423).

A detailed analytical review of the major currency pairs of the Forex market, Bitcoin and Ethereum cryptocurrencies, WTI crude oil, gold index, and S&P500 stock index is further on YouTube channel.

Dmitry Zeland, analyst at a brokerage company MTrading.