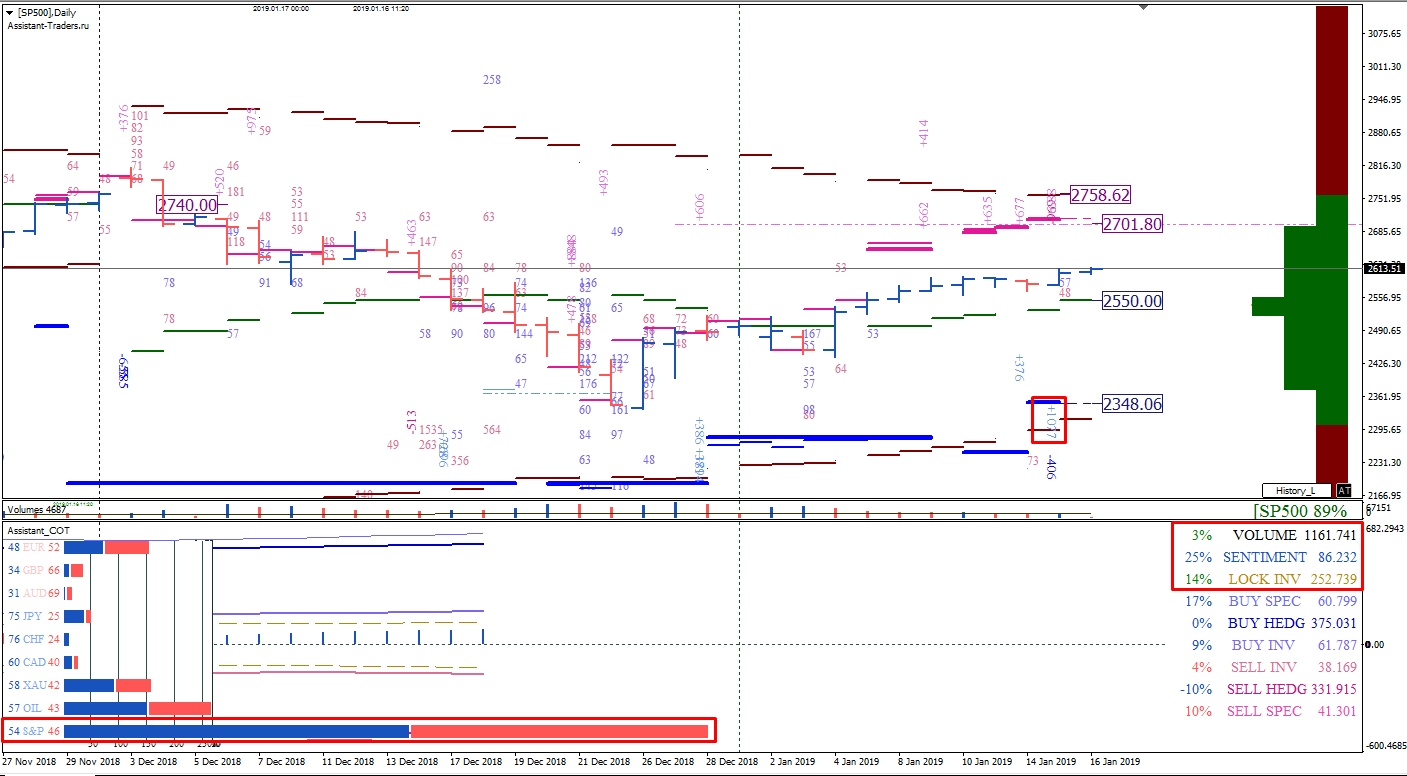

The market owners’ cash investments in CME Group stock derivatives on the S&P500 stock index amounted to $ 1 trillion 161 billion 741 million. The capitalization of investments increased by 3%.

The net advantage of bullish positions increased by 25%. The total net overweight of SPX buyers in monetary terms was $ 86 billion 232 million.

The total investment ratio of SMART MONEY in SPY is as follows: 54% of buyers and 46% of sellers.

The first goal of the increase on the daily timeframe is the historical option level of the growth of positions for decline (2701.80).

The next important resistance is the monthly option level of market maker resistance at the quotation 2758.62.

The closest support level for trading inside the current option month is the monthly market maker balance (2550.00).

Subsequent support is the option level of growth of $ 1 billion 77 million for growth on monthly contracts (2348.06).

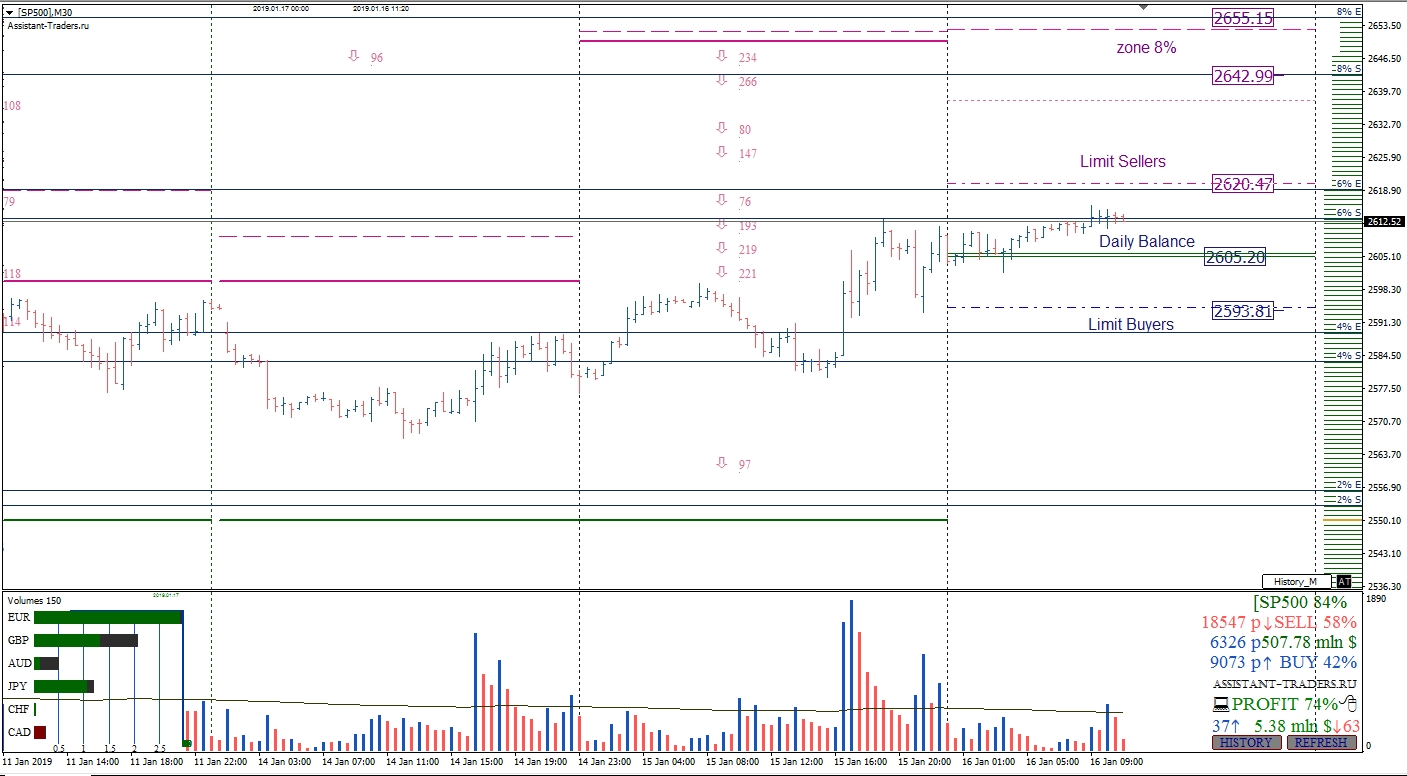

The closest key support level for today is the option balance of the day (2605.20).

The first growth target for the current working day is the level of limit sell orders (2620.47).

The final growth target for the current trading week is the zone of 8% of buyers (2642.99-2655.15).

The next level of support on Wednesday, January 16, is the level of the limit buyer (2593.81).

A detailed analytical review of the major currency pairs of the Forex market, Bitcoin and Ethereum cryptocurrencies, WTI crude oil, gold index, and S&P500 stock index is further on YouTube channel.

Dmitry Zeland, analyst at a brokerage company MTrading.