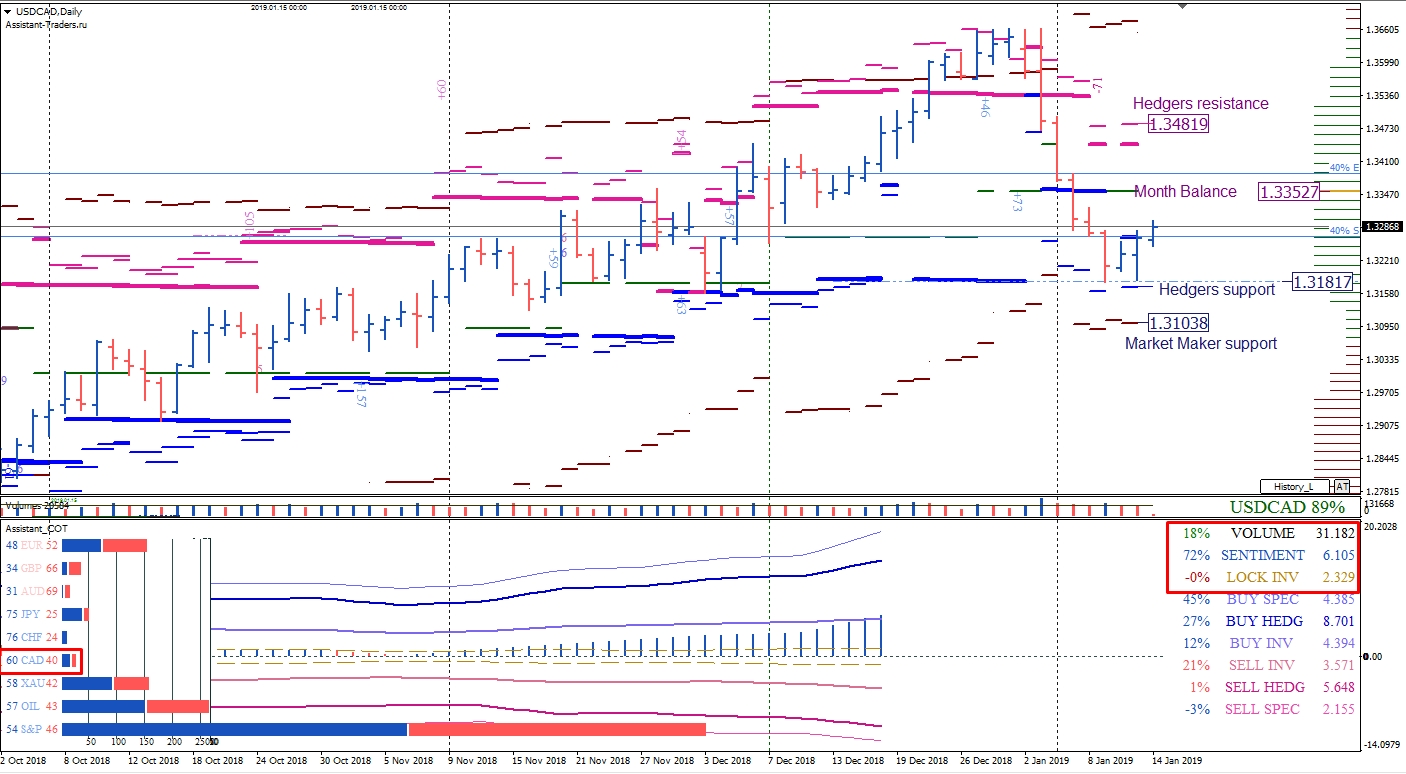

Cash investments among major participants of the CME Group on derivatives trading for the Canadian dollar increased by 18%.

The total capitalization of investments in dollars amounted to $ 31 billion 182 million.

The predominance of bulls increased by 72%. In monetary terms, the overriding customer sentiment was $ 6 billion 105 million.

The number of locked positions of investors decreased by less than 1%. The following is a cash investment in USD / CAD among SMART MONEY: 60% of buyers and 40% of sellers.

The first long-term goal of raising on the daily timeframe is the level of the monthly market maker balance (1.3352).

The next goal of the increase is the zone of resistance of hedgers (1.3481).

The closest support level for trading inside the option month is support for hedgers (1.3187).

The next long-term goal of the decline is the monthly level of market maker support (1.3103).

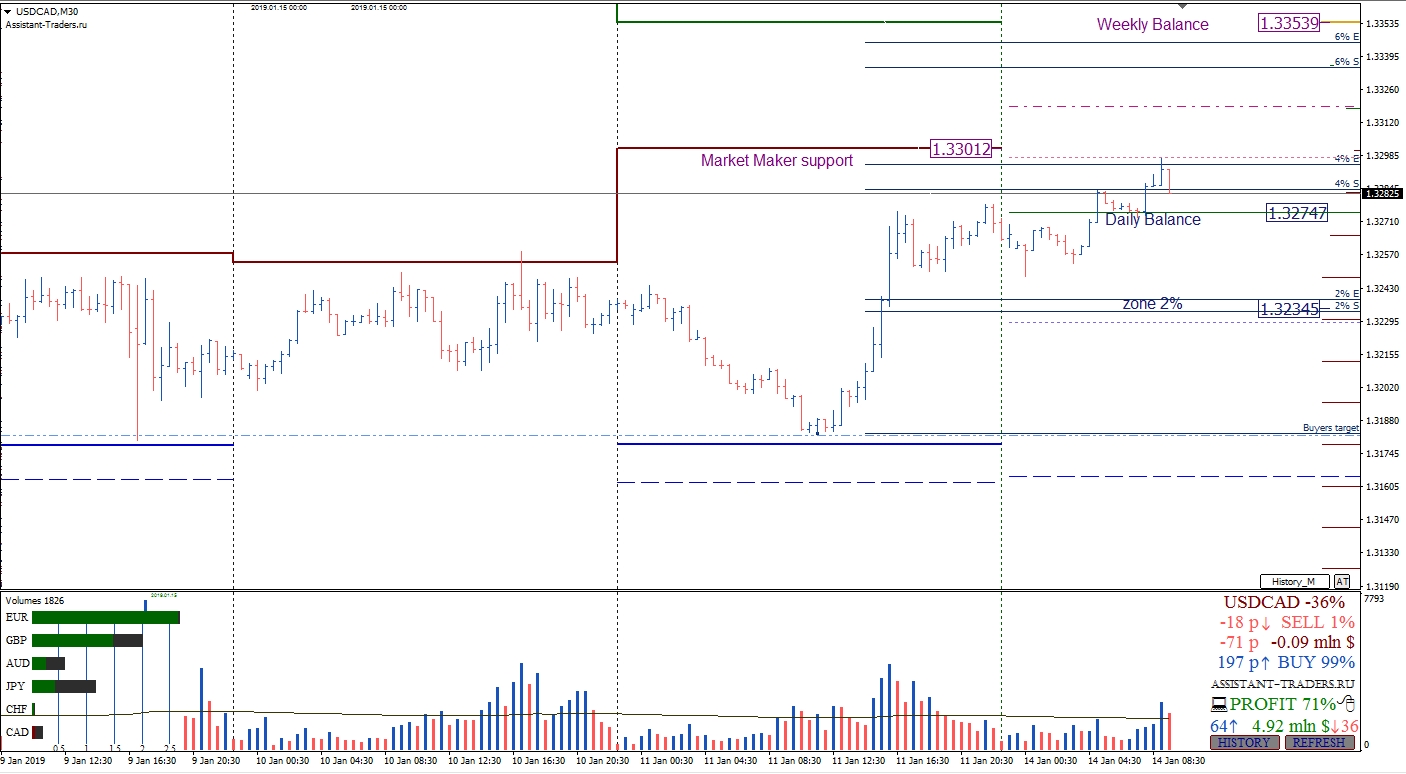

The key level of support for the first working day of the current week is the option balance of the day (1.3274).

In case of a breakdown of the level of the balance of the day, we can expect a decline to the zone of 2% (1.3234).

The closest resistance level on Monday, January 14, is the weekly market maker support level (1.3301).

The next growth target within the working week is the weekly level of the market maker’s balance (1.3353).

A detailed analytical review of the major currency pairs of the Forex market, Bitcoin and Ethereum cryptocurrencies, WTI crude oil, gold index, and S&P500 stock index is further on YouTube channel.

Dmitry Zeland, analyst at a brokerage company MTrading.