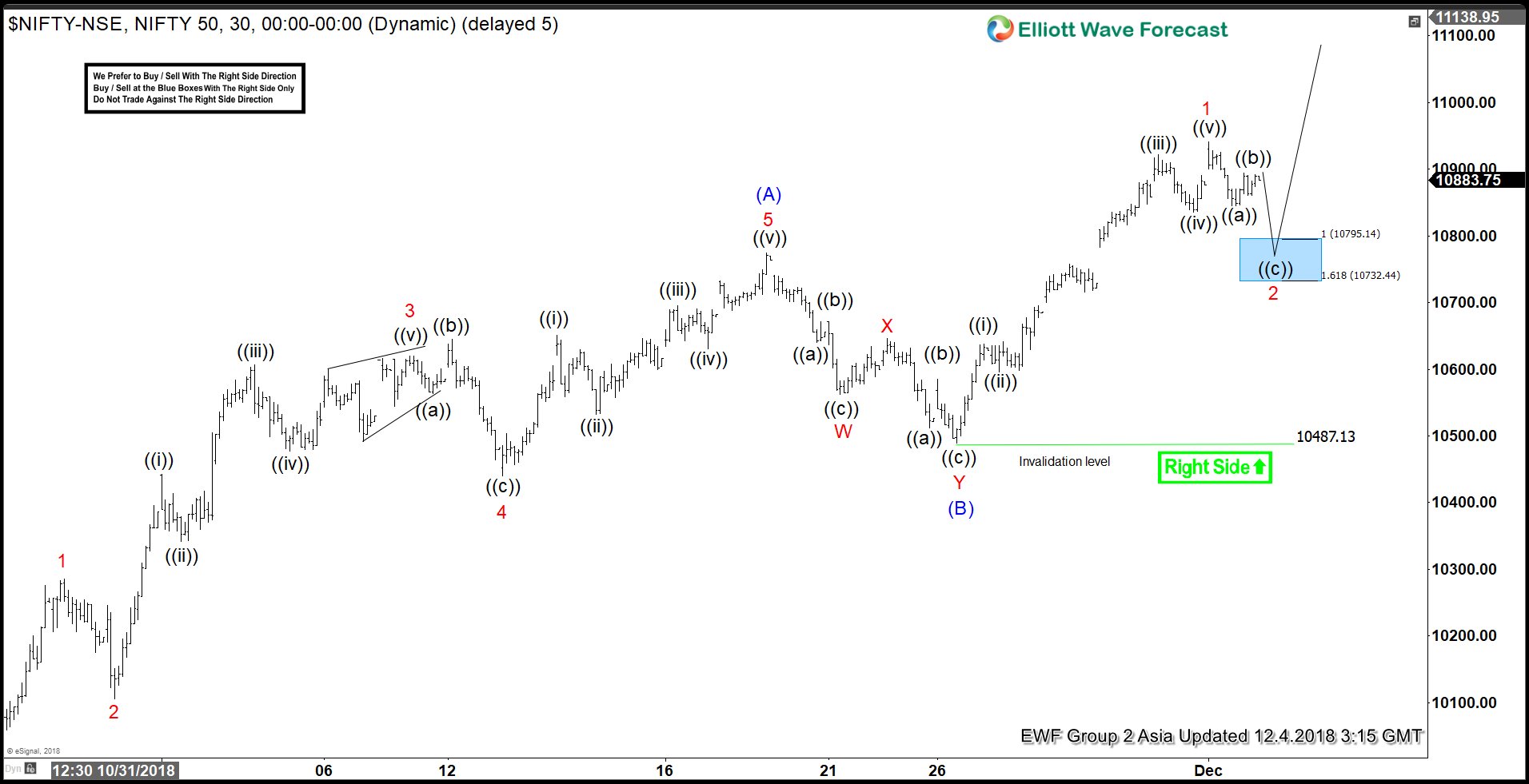

NIFTY is showing an incomplete sequence to the upside in the short term, favoring more upside while above 11/26 low (10487.1). Near term, cycle from 10/26 low (10004) remains in progress as a zigzag Elliott Wave structure. Intermediate Wave (A) ended at 10774.7 as 5 waves impulse Elliott Wave structure and Intermediate wave (B) ended at 10487.13 low.

Internal of wave (A) unfolded as an impulse where Minor wave 1 ended at 10285.1, Minor wave 2 ended at 10105.10, Minor wave 3 ended at 10619.55, Minor wave 4 ended at 10440.55, and Minor wave 5 of (A) ended at 10774.7. Intermediate wave (B) pullback unfolded as a double three Elliott Wave structure where Minor wave W ended at 10562.35, Minor wave X ended at 10646.25 and Minor wave Y of (B) ended at 10487.13.

Up from 10487.13 low, Intermediate wave (C) is in progress as a 5 waves impulse Elliott Wave structure where Minor wave 1 ended at 10941.20. The Index is now correcting cycle from 11/26 low within wave 2 in 3, 7, or 11 swing before the rally resumes. We don’t like selling the pullback and expect to find buyers in 3, 7, or 11 swing for more upside as far as pullback stays above 10487.13 low

NIFTY 1 Hour Elliott Wave Chart