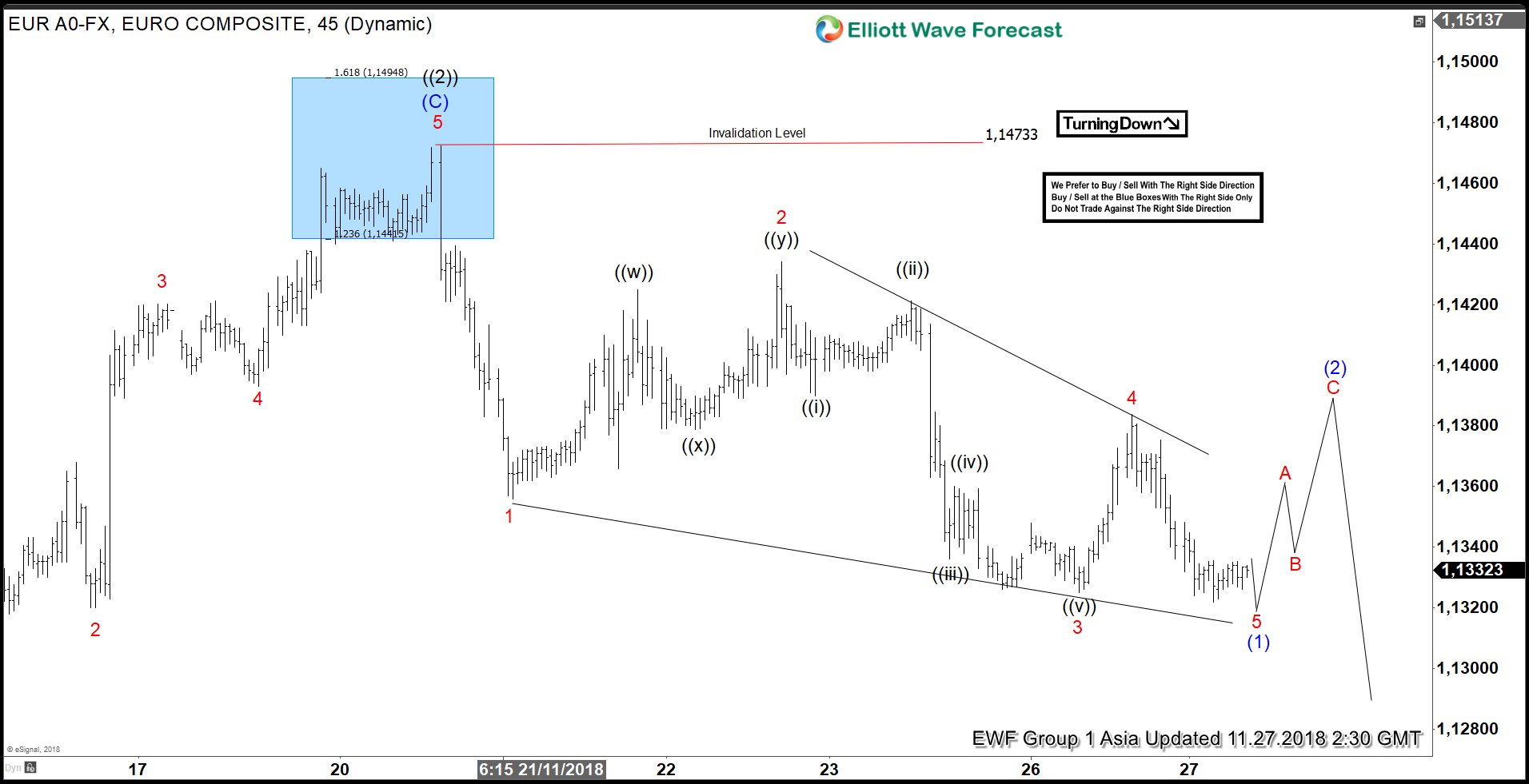

Cycle from Sept 24 high (1.182) in EURUSD remains in progress as an Elliott Wave impulse structure where Primary wave ((1)) ended at 1.1214 and Primary wave ((2)) is proposed complete at 1.147. Pair still needs to break below Primary wave ((1)) at 1.1214 to validate this view. Until then, we still can’t rule out a double correction in Primary wave ((2)) in the form of WXY. Near term, the decline from 1.147 is unfolding in what looks like a leading diagonal Elliott Wave structure.

Down from 1.147, Minor wave 1 ended at 1.1356, Minor wave 2 ended at 1.1434, Minor wave 3 ended at 1.1325, and Minor wave 4 ended at 1.1384. Pair should soon end Minor wave 5 which also completes Intermediate wave (1). Afterwards, it should bounce in Intermediate wave 2 to correct cycle from 11/20 high (1.147) in before the decline resumes. We don’t like buying the pair and expect sellers to appear in 3-7-11 swing as far as pivot at 1.147 high stays intact.

If pair breaks above proposed Primary wave ((2) at 1.147, then it’s doing a double correction and can open further upside towards 1.16 area before the decline resumes. If this happens, we still expect pair to extend lower or at least pullback in 3 waves from 1.16 area as far as pivot at 9/24 high (1.1815) stays intact.