DAX Short Term Elliott Wave view suggests that the Index ended Intermediate wave (X) pullback at 12731.46. The rally from there is unfolding as a 5 waves impulse Elliott Wave structure where Minutte wave (i) ended at 12943, Minutte wave (ii) ended at 12881.5, Minutte wave (iii) ended at 13408.5, and Minutte wave (iv) is proposed complete at 13328.5. Index has scope to extend 1 more leg higher in Minutte wave (v) before ending 5 waves up from 1/2 low (12731.46).

The move higher in Minutte wave (v) should also end Minute wave ((a)) of a larger degree. Afterwards, Index should pullback in Minute wave ((b)) to correct cycle from 1/2 low before the rally resumes. Chasing the Index higher from here is risky, but we don’t like selling the Index either. We expect buyers to appear during Minute wave ((b)) pullback in 3, 7, or 11 swing for an extension higher as far as pivot at 1/2 low (12731.46) stays intact.

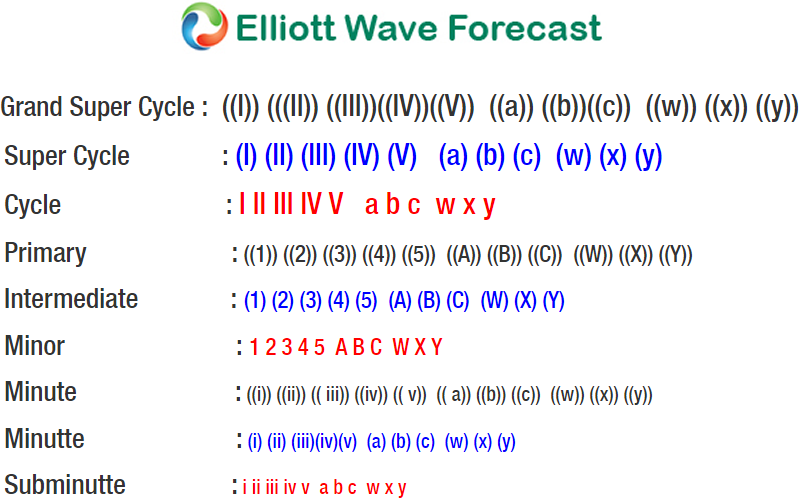

DAX 1 Hour Elliott Wave Chart

Source : https://elliottwave-forecast.com/stock-market/dax-elliott-wave-analysis-2/