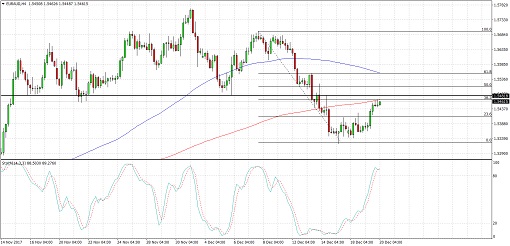

EURAUD previously broke below the neckline of its head and shoulders pattern on the 1-hour time frame to signal a selloff. Price found support around the 1.5340 area and is now pulling back to the broken support near the 1.5500 handle.

Applying the Fib tool on the latest swing high and low shows that this area of interest is between the 38.2% and 50% retracement levels that might keep gains in check. However, the 100 SMA is still above the longer-term 200 SMA to show that the path of least resistance is to the upside.

Stochastic is moving up to show that buyers have the upper hand but the oscillator is dipping into overbought territory to suggest rally exhaustion. Turning lower could draw more selling pressure in and allow the 200 SMA to keep holding as dynamic resistance around the 38.2% Fib.

The euro got a boost from hawkish ECB remarks and news that Germany will be selling more bonds next year. This drove yields higher in the euro region, allowing the shared currency to benefit as well. Data was actually weaker than expected as the German Ifo business climate index fell from 117.6 to 117.2 versus expectations of it remaining unchanged.

Meanwhile, the Aussie is drawing support from the RBA’s less dovish stance and the pickup in risk-taking. Even higher gold prices during risk-off days have been able to prop up the correlated AUD. There are no other reports lined up from Australia for the rest of the week, though, so risk sentiment could be the main driving factor.

German PPI and euro zone current account balance are up for release today and stronger than expected data could remind traders of the upgraded forecasts by the central bank. German GfK consumer climate data and French consumer spending numbers are due on Friday.

By Kate Curtis from Trader’s Way