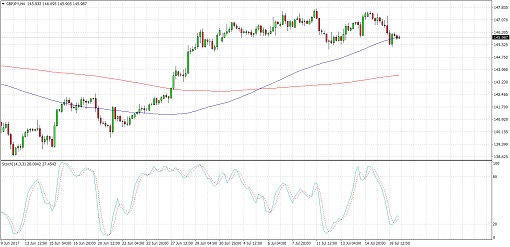

GBPJPY has failed in its last two attempts to break past the 147.50 minor psychological resistance, creating a double top reversal formation. Price is currently testing the neckline at 145.50 and could be due for at least 200 pips in losses if its breaks.

The 100 SMA is still above the longer-term 200 SMA, though, so the path of least resistance is to the upside. Also, the 100 SMA is holding as dynamic support for now and a bounce could take price back up to the tops or higher. Stochastic looks ready to pull up to indicate a pickup in buying pressure but it has room to go lower before hitting oversold conditions.

Economic data from the UK turned out weaker than expected and BOE Governor Carney confirmed that this was in line with BOE estimates. Headline CPI is down from 2.9% to 2.6% while core CPI dropped from 2.6% to 2.4%, lessening pressure on the central bank to tighten monetary policy.

The BOJ has its monetary policy decision lined up on Thursday’s Asian trading session and many are expecting the Japanese central bank to sound dovish. However, recent reports have shown some improvements and there’s also a chance that policymakers could sound more neutral.

UK retail sales are also due later on this week and a drop is eyed, owing to weak wage inflation and rising price levels. However, analysts project that a 0.4% rebound over the earlier 1.2% slump could be in the cards.

By Kate Curtis from Trader’s Way