Hello everyone! In today’s article, we’ll examine the recent performance of Apple Inc. ($AAPL) through the lens of Elliott Wave Theory. We’ll review how the powerful rally from the August 2025 low unfolded as a textbook 5-wave impulse and discuss our evolving forecast for the next move. Let’s dive into the structure and expectations for this tech giant.

5 Wave Impulse Structure + ABC correction

$AAPL 1H Elliott Wave Chart 8.21.2025:

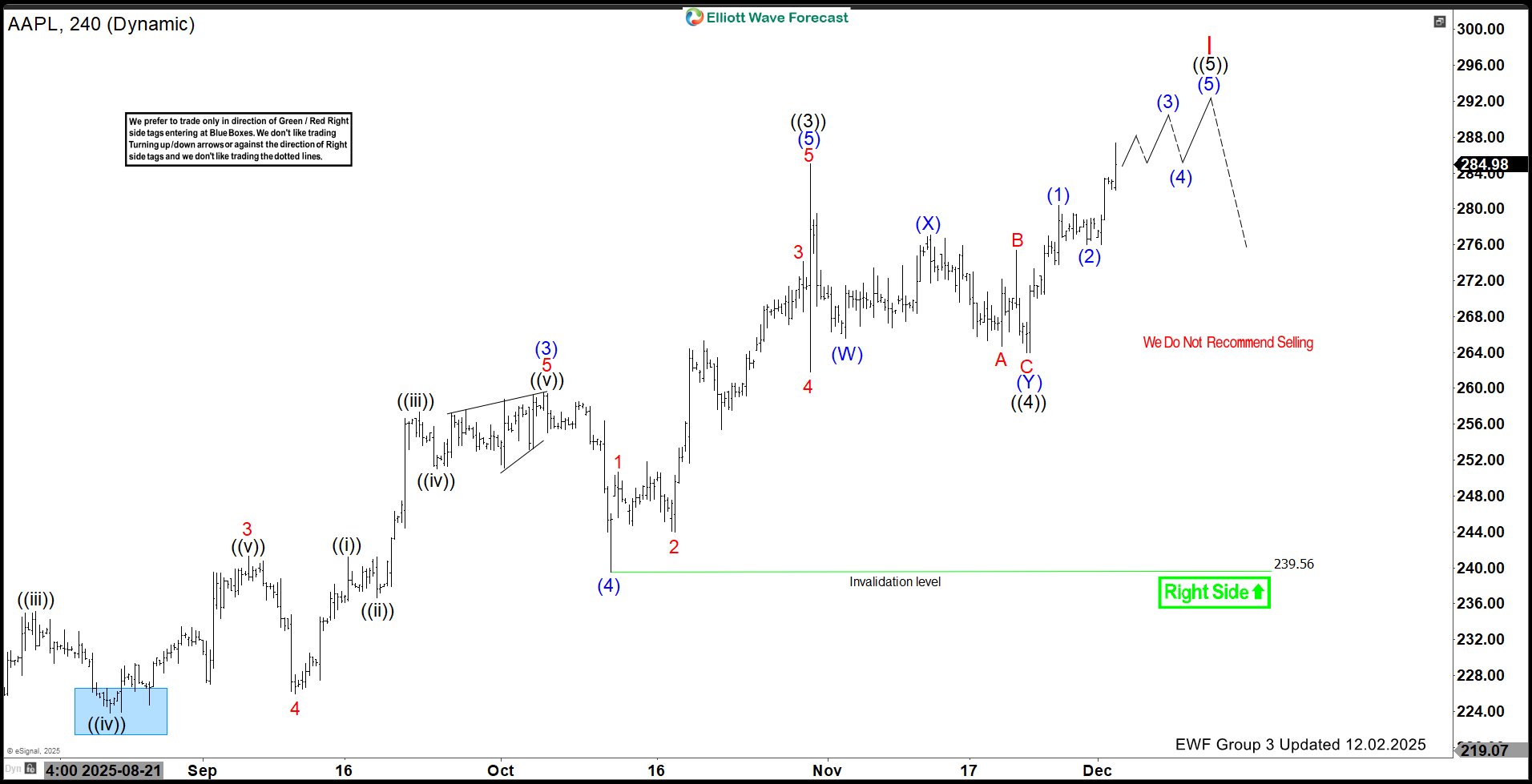

$AAPL 4H Elliott Wave Chart 12.02.2025:

Fast forward three months to our latest update, and the charts tell a compelling story. $AAPL bounced right from that “blue box.” The stock was able to hold the low and dips kept finding buyers. The stock hit new all-time highs and is up about 30% from the blue box area.

Right now, the stock is still climbing. It is in what we call wave (3) of wave ((5)). This means more gains are likely. We think $AAPL could reach $290 –$298 next. After that, we might see another pullback.

Conclusion

In conclusion, our Elliott Wave analysis of $AAPL continues to prove accurate, suggesting that the stock remains well-supported against its April 2025 lows. For traders who capitalized on the entry opportunities presented in the “blue box” area, the $290–$298 zone should be closely monitored as the next significant objective. In the interim, keeping a vigilant eye out for any healthy corrective pullbacks could present fresh entry opportunities for those looking to join the trend.

By applying the principles of Elliott Wave Theory, traders can gain a deeper understanding of market cycles, better anticipate the structure of upcoming moves, and ultimately enhance their risk management strategies in dynamic markets like the current one for $AAPL.

Source: https://elliottwave-forecast.com/video-blog/apple-aapl-soars-blue-box-area-290-target-ahead/