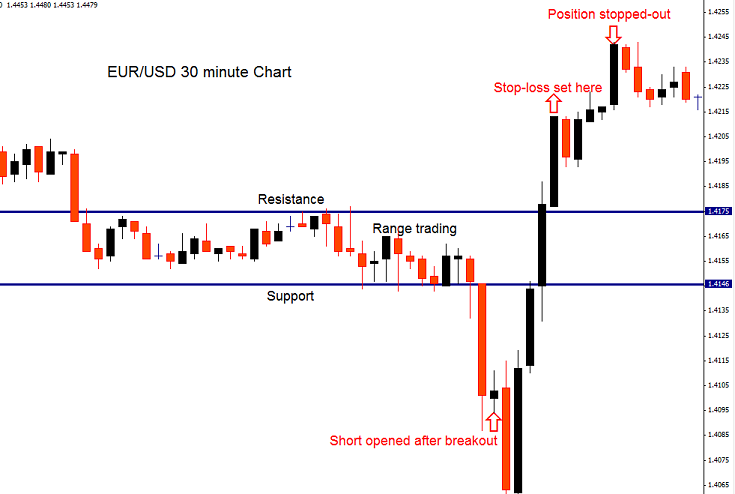

Novices need to acquire trading experience in order to be able to select good stop-losses and profit targets for all the positions that they open. These are important activities to master because Forex has such an unpredictable and volatile nature that it is easily stop-out positions protected by small stops only i.e. up to 50 pips. The following chart taken from a forex trading platform shows such a trading setup.

In the above diagram, price is trading a tight range before it breakouts to the downside. A new short is opened protected by a stop-loss positioned about 50 pips above the old resistance level. Unfortunately, in this case a large bull spike stopped out the short forcing a loss.

Those people that are involved in options trading, CFDs, binaries and other derivatives are also advised to develop trading strategies that have good risk-to-reward and win-to-loss ratios. However, these techniques also take time to master. Do novices have any plausible shortcuts available to them? Yes, they do because a trading strategy has been designed to overcome these problems.

How does a Large Stop-loss Strategy work?

Although this strategy looks strange as its main concepts appear to contradict many of the recommended principles associated with Forex Trading, many traders have achieved success using them. The basic principle is that you trade using a very large stop, in the order of 500 pips, while plundering profits of 50 pips or so per position.

This idea could even be consider as a macro version of scalping strategies. Again, the central idea behind scalping strategies is to nip in and out of positions quickly which will minimize your risk exposure as well as capturing small profits of 5 to 10 pips. With regards to large stop-loss strategies, you will appreciate that a large stop-loss of 500 pips is difficult for price to stop-out. This concept therefore provides a basis for beginners to trade because they no longer need to develop the skills to protect normal positions using smaller stop-losses.

The risk-to-reward ratio of 1 to 10 of this type of trading strategy is not very good. However, the central point is that the effort required by the price to stop-out a 500 pip stop is exponentially higher than that a 50 pip one. So, the idea is to attain an impressive win-to-loss ratio which will then counter a weak reward-to-risk ratio. For example, if you could record 6 wins of 100 pips against 1 loss of 540 pips, then you would register a profit of 60 pips.

Overcoming Potential Problems

However, although this theory appears plausible, you must perform this strategy accurately. This is because your trades could become stranded in negative territory. Price could simply remain within this area for extensive time periods. Should such a development then you would not be able to record any new profits for some considerable time.

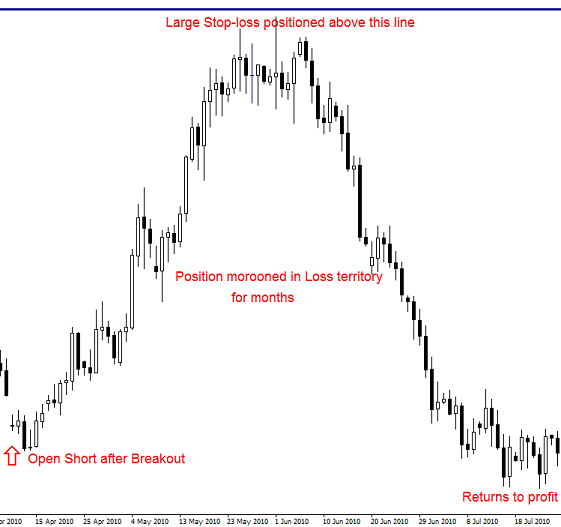

To resolve this issue, you need to deploy a well-proven money management strategy. For example, you should just wager between 0.1% and 0.2% of your total equity per trade. You will provide optimum protection for your equity by doing so. You will also be able to permit a few trades to become isolated until they record profit status. Also by risking such minimum amounts, you will be able to initiate a quantity of positions concurrently. The following chart illustrates this problem.

The above chart shows that a new short position was opened after the breakout identified towards the bottom left. A large stop-loss was used and positioned above the blue line at the top of the chart. Unfortunately, price reversed direction leaving the position in limbo before it finally return to profit months later.

An important benefit of this trading strategy is that it permits the less experienced trader more room to make errors which they would not otherwise be able to if they persistently instigated trades protected by smaller stop-losses. Some newbies enquiry why they cannot wager a greater percentage of their account balance e.g. 10%. They believe that this action should be possible because they are utilizing such a large stop-loss.

However, this is definitely not a good idea if you acknowledge that 10 consecutive losses risking 10% per trade would lose in excess of 66% of your account balance. In comparison, by risking just 2% per position than a series of 10 successive losses would lose about 17% of your account balance. Clearly, the latter produces significantly better protection.

Although the concepts of large stop-loss strategies appear strange at first, they can be molded into effective tools possessing many benefits especially for novice traders.