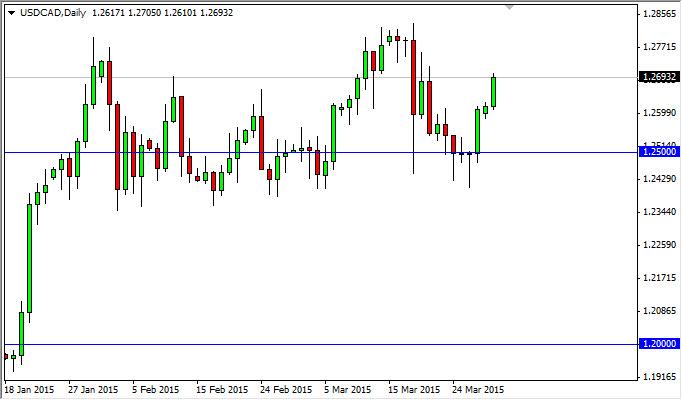

The USD/CAD pair broke higher during the course of the session on Monday as we continue to see bullishness in this market. Quite frankly, the oil markets are doing absolutely nothing to benefit the Canadian dollar right now, and as a result we feel that it’s only a matter of time before we test the 1.28 level. On top of that, we believe that the market will break above there and head to the 1.30 level, which was the massive resistance barrier that stopped this market from going any higher at the height of the financial crisis a few years ago. With that, you know there has to be a significant barrier at that point, and quite a bit of selling pressure. With this in mind, it’s not very surprising to us that this market has had a backup several times in order to build up enough momentum to make that run.

If we pullback from here, we think this is simply going to be another opportunity to pick up value in the US dollar as it remains the strongest currency in the world. On top of that, the Canadians will suffer due to soft oil prices, and the fact that the Bank of Canada has recently cut interest rates in a surprise move. With that, traders are going to be a little bit skittish when it comes to shorting this pair for any real length of time.

The 1.24 level below continues to be supportive, and we feel that every time this market pulls back to that area will more than likely offer a buying opportunity. We look at supportive candles as a reason to start going long, and quite frankly even if we broke below there we feel there is so much support all the way down to the 1.20 level to even think about selling. We are very bullish and we do think that eventually we break above the 1.20 level. Once that happens, this will become a buy-and-hold type of situation. At that point time if you are not comfortable hanging onto the longer-term trend, you to simply buy every time it dips.