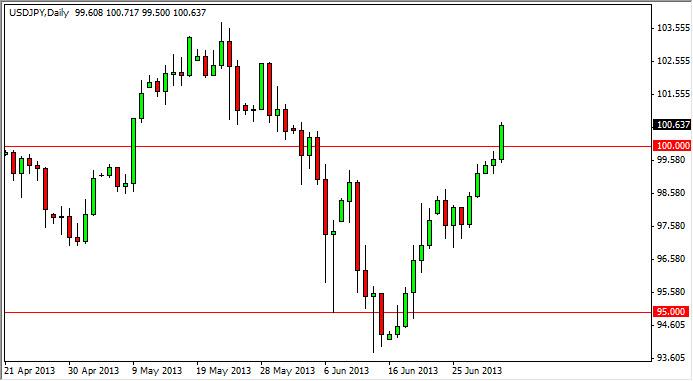

The USD/JPY pair rose during the session on Tuesday, breaking above the 100 handle finally, as we expected. This market looks like it’s ready to head into another leg higher, but it should be noted that the next two sessions could be a bit thin as far as trading volume is concerned, simply because the Americans will be the way celebrating Independence Day. On top of that, Friday will probably be sent as well, and Friday happens to be nonfarm payroll Friday as well, which of course is always greatly influential as to how this market moves.

That being said, we do see a bit of resistance of the 100.75 level, but think it’s minor at best. In fact, we fully expect to see the 103.50 level printed sooner or later. The Bank of Japan continues to work against the value of the Yen, and as long as interest rates continue to favor the Dollar over the Yen, this market should continue to go higher, which is what we fully expect to see over the next several years. In fact, a move to the 110 level wouldn’t be overly surprising by the end of this year.

Expect choppy conditions though, because this is a market that is been moved by headlines and rumors. The Dollar continues to be King when it comes to the Forex markets, so of course is market is going to be biased to the upside. On top of that, it appears that the “carry trade” is starting to come back into play, as the Yen will be sold off against most currencies. This will be especially true in the higher-yielding currencies, but the Dollar is in a special place simply because of the interest rate differential between the bond markets above countries, but it also is the “safe haven” as well. Because of this, we are buying pullbacks, and expect to see the 100 level offer a bit of support if we do pullback to that area. On top of that, we are comfortable enough to start buying on a break of the highs as well.

Written by FX Empire