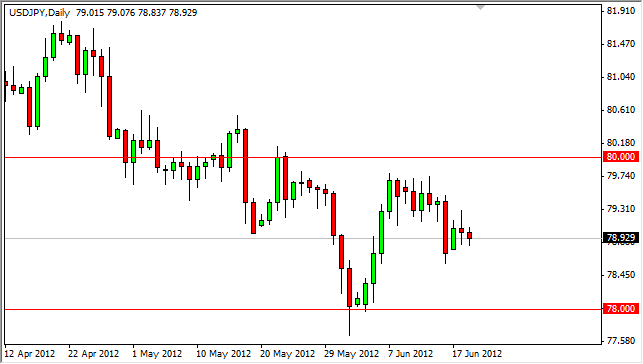

The USD/JPY pair fell slightly during the session on very little motion one way or the other during the Tuesday session. The pair is essentially in “No Man’s Land” as the 78 level and the 80 level are both significantly important in the direction of this pair. The Bank of Japan has been active in this pair, and as a result – the pair can’t necessarily fall as fast as many traders would like.

The Federal Reserve will be the one thing that traders pay attention to when it comes to this pair. Yes, we already know that the Bank of Japan has intervened in this pair several times, and that the central bank has also eased monetary policy in several other ways as well. However, when it comes to the weakening of your own currency – nobody can compete with the Federal Reserve.

The Fed has a two day meeting that is wrapping up at the end of the session today, and as a result the market will be waiting as the Fed will have an announcement at 2:15 pm local time in America to let the market know if any further easing is necessary. If the Fed manages to not ease, this could put a real bid in the US dollar. The situation in the market is that the traders of this pair are weighing the easing attitudes of the two central banks. If the Fed fails to ease – this would leave most traders buying as the Japanese most certainly are going to continue to ease.

The easing of the monetary policy by the Fed could come in several different forms, so even if they do we could see a muted response. Because of this with think that the daily close will be the most important thing to pay attention to at the end of the day. The pair needs to break above the 80.50 level on the close in order to buy this market as it would show a real breaking of the major resistance. A breakdown in this market is going to be difficult to sell as the BoJ could get involved.

Written by FX Empire