EURUSD has displayed a promising sign, potentially interrupting its recent decline. This analysis examines the technical situation and explores potential scenarios for the currency pair.

EURUSD Breaches Resistance:

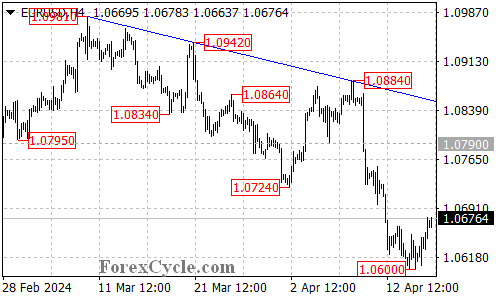

- Short-Term Downtrend Challenged: EURUSD has broken above the resistance level at 1.0670. This breakout suggests a possible completion of the short-term downtrend from 1.0884.

Is This a Trend Reversal or Correction?

- Downtrend From 1.0981 Still Intact: It’s important to consider the bigger picture. The current rise could be interpreted as a correction within the longer-term downtrend that began at 1.0981.

- Upside Potential: Despite the larger downtrend, a further rally could be expected in the coming days. The next potential target zone to watch could be around the 1.0760 area.

- Falling Trend Line as a Hurdle: A break above 1.0760 would be a more significant development. If the price surpasses this level, it could aim for the falling trend line on the 4-hour chart. A breakout above the trend line would suggest a stronger possibility of a trend reversal.

Support Levels to Consider:

- 1.0600 Initial Support: The initial support level to monitor is at 1.0600. This level coincides with the low point of the short-term downtrend.

- Downside Risk Persists: A breakdown below 1.0600 would signal a continuation of the downtrend. The next potential target zone in this scenario could be around 1.0550.

Overall Sentiment:

The technical outlook for EURUSD is uncertain in the short term. The breakout above 1.0670 offers some hope for a short-term trend reversal. However, the uptrend from 1.0600 could still be a correction within the larger downtrend. Close monitoring of price action around the key levels mentioned above will be crucial in determining the future direction of EURUSD.