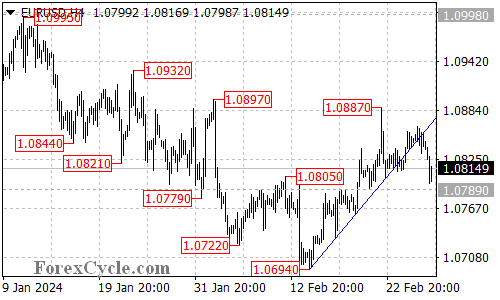

EURUSD has taken a turn lower, breaking below the rising trend line that had been guiding its recent ascent on the 4-hour chart. This raises concerns about a potential trend reversal, but it’s crucial to analyze the situation further before drawing conclusions.

Uptrend Under Pressure: Can Support Hold?

- 1.0789: Crucial Support Level: The immediate support level to watch is 1.0789. If the price holds above this level, it could be interpreted as a healthy pullback within the ongoing uptrend that began at 1.0694. This would suggest that a further rise is still possible after this consolidation phase.

Resistance Levels to Consider for a Potential Rebound

- 1.0840 Initial Hurdle: If the bulls manage to regain control and push the price above 1.0840, it could signal a potential short-term reversal and a possible retest of the broken trend line.

- 1.0887 and 1.0950: Resistance Awaits: Overcoming the 1.0887 resistance level would be a more significant bullish signal. This could pave the way for a further rise towards the 1.0950 area, potentially solidifying the uptrend.

Breakdown Scenario: Watching for Trend Confirmation

- 1.0789 Breach: Downturn Confirmation: A breakdown below the 1.0789 support level would be a significant development. This could confirm the completion of the uptrend from 1.0694 and potentially lead to a decline towards the next support levels at 1.0750 and 1.0694, marking a possible trend reversal.

Overall Sentiment:

The technical picture for EURUSD presents mixed signals. While the break below the trend line is a bearish development, the presence of the 1.0789 support level offers some hope for the bulls. The price action around this key support zone will be crucial in determining whether this is a temporary pullback within the uptrend or the start of a new downtrend.