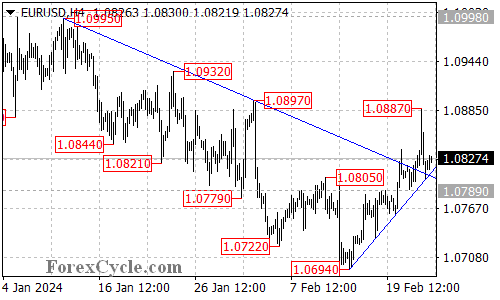

EURUSD has staged a dramatic turnaround, breaking above the falling trend line on the 4-hour chart. This move raises the question: is the recent downtrend truly over, or are we witnessing a temporary pause?

Uptrend Confirmed: Downturn Reversed?

- Trend Line Breach: The break above the falling trend line is a significant technical development. It suggests a potential reversal of the downtrend and the start of a new uptrend from the recent low of 1.0694.

- Rising Support: Further strengthening the bullish case, EURUSD now rests above a rising trend line on the 4-hour chart. As long as the price stays above this trend line, the recent pullback from the 1.0887 peak could be interpreted as a healthy consolidation within the nascent uptrend.

Potential for Continued Growth:

- Resistance Ahead: If the uptrend persists, the next target for EURUSD could be the 1.0950 level, marking potential resistance. Surpassing this level would further solidify the bullish momentum.

Support Levels to Watch for Pullbacks:

- 1.0789 Crucial Support: A breakdown below this key support level would indicate a potential loss of momentum and a possible return to the 1.0750 area.

- 1.0694: Downtrend Resumption?: A further breach below 1.0750 could trigger another fall towards the 1.0694 level, potentially signaling a resumption of the downtrend.

Overall Sentiment:

The technical picture offers a cautiously optimistic outlook for EURUSD in the near term. The break above the falling trend line and the presence of a rising trend line suggest a potential trend reversal. However, confirmation will come from holding above the 1.0789 support level and pushing towards 1.0950 resistance. Monitoring the price action around these key levels will be crucial in determining the pair’s next move.