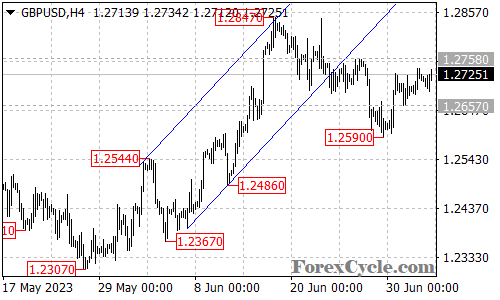

GBPUSD is currently approaching a key resistance level at 1.2758, and a decisive break above this level could potentially trigger a further upside move towards the next resistance at 1.2847. Traders closely monitoring the price action will be keeping a close eye on this level as it could serve as a catalyst for renewed buying interest in the pair.

On the downside, immediate support is seen at 1.2657. A breakdown below this level might lead to a retracement towards the 1.2590 support area. If the selling pressure intensifies and the price breaches the 1.2590 level, the pair could target the 1.2520 area as the next significant support zone.

It is important to watch for a decisive break above the resistance at 1.2758 to confirm the potential for further upside movement. Such a breakout would suggest a shift in market sentiment and could attract more buyers into the market. Traders looking for opportunities to join the upward momentum may consider initiating long positions if the price convincingly surpasses the resistance level.

However, it is essential to exercise caution and monitor the price action closely. Sustained buying pressure and a breach of the resistance level are needed to validate the bullish scenario. False breakouts or lack of follow-through buying could result in a reversal or consolidation phase.

In summary, GBPUSD is currently facing resistance at 1.2758, and a breakout above this level could lead to further upside momentum towards 1.2847. Immediate support is located at 1.2657, with a breakdown potentially leading to a retracement towards 1.2590. Traders should closely monitor the price action and be prepared to adjust their trading strategies based on market developments and key support and resistance levels.