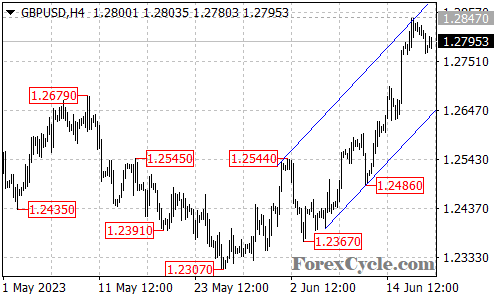

The GBPUSD currency pair has demonstrated resilience, remaining within a rising price channel on the 4-hour chart and sustaining its uptrend from 1.2307. The recent pullback from the high of 1.2847 can be seen as a consolidation phase within the broader upward movement.

Traders can anticipate the potential resumption of the uptrend once the consolidation is complete. The next target for GBPUSD is set at the psychological level of 1.3000, which represents a significant resistance area. Further upside potential may be expected beyond this level, in line with the prevailing uptrend.

To validate the continuation of the uptrend, it is important for the price to remain within the confines of the rising price channel on the 4-hour chart. This channel serves as a crucial technical indicator, and as long as the price stays within it, the uptrend remains intact. However, a decisive break below the channel support may hint at a possible trend reversal and should be closely monitored.

In the near term, immediate support is located at 1.2750. A breach below this level could trigger a retracement towards the lower boundary of the rising price channel. Traders should pay close attention to price action around this support level, as a decisive break below it may indicate a deeper correction or the completion of the ongoing uptrend.

In summary, the GBPUSD currency pair remains within a rising price channel on the 4-hour chart, sustaining its uptrend from 1.2307. The recent pullback from 1.2847 can be interpreted as a consolidation phase, with further upside potential expected after the consolidation is complete. The next target is at the psychological level of 1.3000. Immediate support lies at 1.2750, and a break below this level may warrant caution and further analysis. Traders should closely monitor price action and incorporate technical and fundamental analysis to make informed trading decisions based on the evolving market conditions.