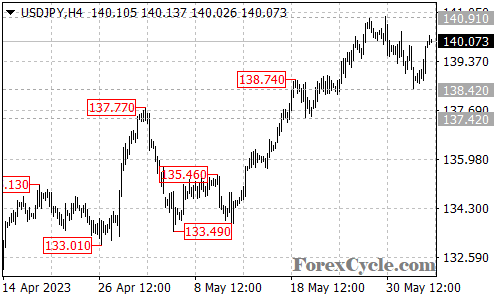

The USDJPY currency pair has experienced a significant pullback, reaching as low as 138.42. However, the subsequent bounce suggests that the pair remains in the overall uptrend that started from the 133.49 level. This bounce indicates a potential continuation of the upward movement in USDJPY.

With the recent rebound, traders are now anticipating a further rise in the pair. The next key level to watch is the 140.91 resistance. A successful breakout above this level would likely trigger additional buying interest and could potentially propel USDJPY towards higher targets. The upside move may target the 142.00 level, followed by the 145.00 area.

To maintain the bullish momentum, it is important for USDJPY to hold above the immediate support level at 138.42. As long as this support level remains intact, the upward bias is likely to continue. Traders will monitor the price action around this support level for any signs of renewed buying pressure, as it would confirm the strength of the ongoing uptrend.

On the downside, a break below the 138.42 support level would raise concerns about the sustainability of the upward move from 133.49. Such a break would suggest a possible shift in market sentiment and could lead to another decline towards the 135.00 support area.