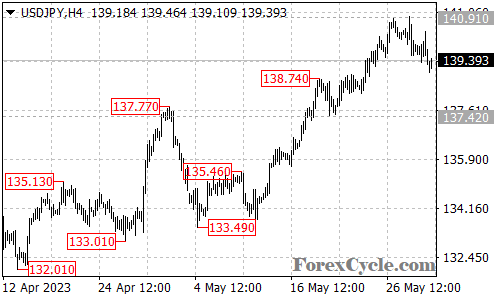

The USDJPY currency pair has entered a consolidation phase following its previous uptrend from 133.49. Traders are closely monitoring the pair’s price action for potential trading opportunities as it navigates this consolidation period.

Currently, there is a possibility of a deeper decline towards the 138.60 area. However, as long as this support level holds, the overall bullish bias remains intact. In such a scenario, the pair could resume its upside move, with the next target potentially being around the 142.50 level once the consolidation phase concludes.

On the downside, a breakdown below the 138.60 support level would suggest that the prior uptrend has potentially reached its completion at the recent high of 140.91. If this occurs, further downside pressure could push the pair towards the 135.00 area.

Traders and investors should closely monitor price action near the support and resistance levels mentioned above. Key technical indicators and patterns may provide additional guidance regarding the pair’s future direction.