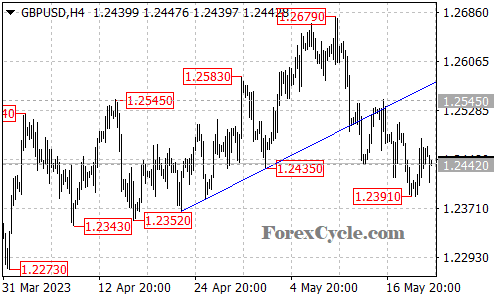

The GBPUSD currency pair remains locked in a persistent downtrend, with the recent bounce from 1.2391 being viewed as a period of consolidation within this overall bearish trend. Traders should exercise caution as the pair grapples with key levels and the potential for further downside movement.

As long as the resistance level at 1.2545 holds, the downtrend is expected to resume. This level will be closely monitored by market participants, as a failure to surpass it could lead to renewed selling pressure. In such a scenario, the pair could experience a further decline towards the 1.2350 support level, with subsequent potential targets at 1.2280.

On the upside, a breakout above the resistance level of 1.2545 would signal a potential shift in the market sentiment. Such a move could suggest that the downtrend has already completed at 1.2391, leading to the possibility of another rise towards the 1.2700 area. Traders will closely watch for any indications of sustained bullish momentum and monitor price action around this critical resistance level.

In summary, the GBPUSD currency pair maintains its downtrend from 1.2679, with the recent bounce from 1.2391 likely representing a consolidation phase. Resistance at 1.2545 is a crucial level to watch, as a failure to surpass it would support the resumption of the downtrend. Downside targets include 1.2350 and 1.2280. Conversely, a breakout above 1.2545 could indicate a potential reversal, leading to a rise towards 1.2700. Traders should remain vigilant and adapt their strategies accordingly to navigate the GBPUSD market effectively.