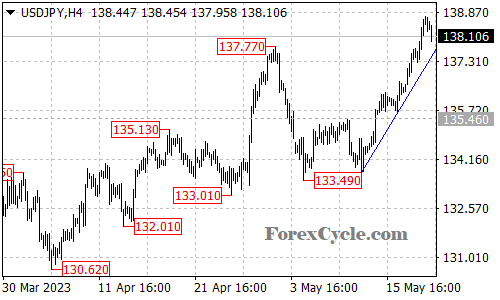

The USDJPY pair has exhibited a strong upside move from its low point at 133.49, extending its rally to reach as high as 138.74. Traders are closely monitoring the pair as it continues to demonstrate bullish momentum, eyeing potential further gains in the near term.

As long as the price remains above the rising trend line on the 4-hour chart, the upward trajectory of USDJPY is likely to persist. This suggests that buyers are in control of the market and may aim for the next target around the 140.00 level. The positive sentiment surrounding the pair reflects the prevailing optimism for the US dollar and its potential for continued strength against the Japanese yen.

However, it is crucial to consider potential downside risks. A breakdown below the rising trend line would indicate a possible completion of the recent upside movement. In such a scenario, USDJPY could experience a corrective pullback, with the next support level likely to be found around 135.00. Traders should closely monitor the price action and be prepared for potential shifts in market dynamics.

In summary, USDJPY has displayed a strong upside move, extending its rally from 133.49 to 138.74. The bullish sentiment remains intact as long as the price stays above the rising trend line on the 4-hour chart. The next target for the pair lies around the 140.00 area. However, a breakdown below the trend line may signal a completion of the upside move, leading to a potential pullback towards the 135.00 support level. Traders should closely monitor market conditions and adjust their strategies accordingly to navigate potential opportunities and risks in the USDJPY pair.