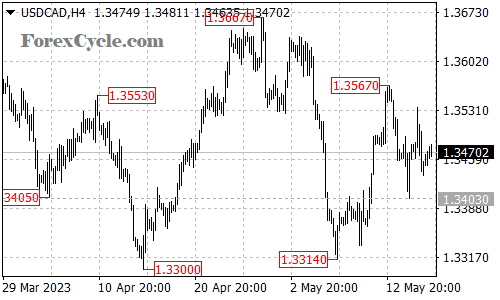

The USDCAD pair has been trading within a relatively range, oscillating between the levels of 1.3403 and 1.3567. This sideways movement suggests a period of consolidation as the market awaits a clear breakout direction.

For the past few days, the price action of USDCAD has been confined within this trading range, indicating a balance between buyers and sellers. Traders should note that during such consolidation phases, it is common for the market to gather momentum before making a decisive move.

In the near term, it is likely that USDCAD will continue to trade within the established range. Traders should closely monitor the price action for any signs of a breakout. A breakdown below the lower support level at 1.3403 could signal further downside pressure, potentially leading to a decline towards the 1.3300 level.

Conversely, a breakout above the upper resistance level at 1.3567 could suggest a shift in market sentiment and a potential uptrend continuation. If the price manages to surpass this resistance, it may set the stage for a move towards the next target at 1.3667.

It is important to exercise caution and wait for a clear breakout confirmation before initiating any new positions. False breakouts can occur, and traders should look for sustained momentum and strong volume to support their trading decisions.

In conclusion, USDCAD is currently locked within a trading range between 1.3403 and 1.3567, indicating a period of consolidation. Traders should await a clear breakout and confirmation before considering new positions. A breakdown below 1.3403 may lead to further downside potential, while a breakout above 1.3567 could pave the way for an upward move towards 1.3667. Staying informed and practicing risk management are key aspects of successful trading in the USDCAD pair.