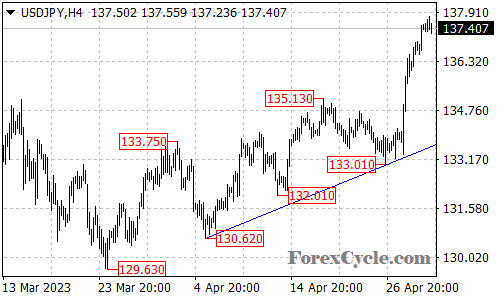

USDJPY is currently facing resistance at the 137.90 level, and a sideways movement between the range of 135.70 and 137.80 could be seen in the near term. As long as the support level at 135.70 holds, the upside movement could be expected to continue and the next target would be at the 139.00 area.

On the other hand, a break below the support level at 135.70 could bring the price back towards the rising trend line on the 4-hour chart. This could potentially signify a change in the trend, and traders should pay close attention to any developments in the market.

The USDJPY pair has been in an uptrend since the Mar 24 low of 129.63, and a break above the 137.90 resistance level could indicate that the pair is gaining momentum.

Overall, the USDJPY pair is currently in a consolidation phase, with the price oscillating between the 135.70 support level and the 137.90 resistance level. As such, traders should exercise caution and wait for a clear breakout before taking any positions.