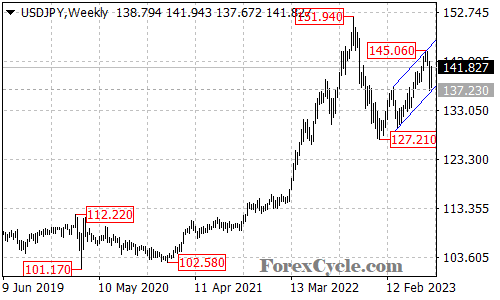

USDJPY has demonstrated strength by remaining within a rising price channel on the weekly chart, affirming its position in the long-term uptrend from 127.21.

Market participants are closely monitoring this upward movement, with expectations of continued gains in the currency pair. As long as USDJPY remains within the confines of the rising price channel, the upside momentum is anticipated to persist. The next significant target lies at 151.94, representing the previous high.

Traders are closely watching the lower boundary of the rising price channel, marked by key support at 137.23. As long as this support level remains intact, the bullish outlook remains intact. However, caution is advised, as a decisive break below 137.23 could trigger another downward move towards the previous low at 127.21.

With the current positive sentiment surrounding USDJPY, market participants are contemplating strategic moves to capitalize on potential gains towards the 151.94 target. Nonetheless, it is essential to be prepared for short-term fluctuations and exercise prudent risk management to navigate any potential downside risks.

In conclusion, USDJPY continues to exhibit strength, remaining within a rising price channel on the weekly chart and sustaining its long-term uptrend from 127.21. The currency pair’s outlook remains bullish as long as it stays within the channel, with the next target set at 151.94. However, traders should closely monitor key support at 137.23, as a breakdown below this level could trigger a corrective move towards the previous low at 127.21. As the market evolves, investors are keen to witness USDJPY’s performance and seize opportunities presented by this dynamic currency pair.