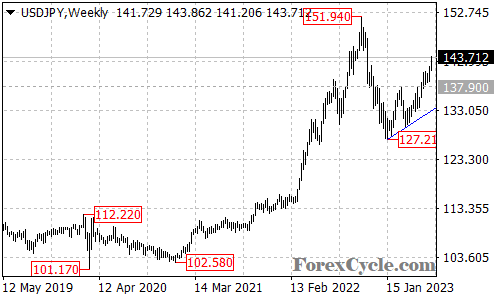

The USDJPY currency pair has experienced a significant upside move from 127.21, reaching as high as 143.86. This bullish momentum suggests that further gains may be on the horizon for the pair over the next several weeks.

Traders and investors are closely monitoring the price action in USDJPY as it approaches key resistance levels. The next target for the pair is seen at the psychological level of 145.00, followed by 151.94. These levels represent potential areas where traders may consider taking profits or adjusting their positions.

However, it is important to note that support plays a crucial role in determining the sustainability of an uptrend. In the case of USDJPY, the immediate support level is located at 137.90. A breakdown below this level could indicate a potential reversal or correction in the price. Such a move might bring the price back towards the rising trend line on the weekly chart, which has provided support in the past. A further breakdown below the trend line support could open the door for a more substantial decline towards the 118.00 level.

In summary, USDJPY has displayed a strong upside move, reaching as high as 143.86. The potential for further gains in the coming weeks exists, with targets at 145.00 and 151.94. However, traders should be mindful of the immediate support level at 137.90, as a breakdown could indicate a reversal or correction. Monitoring key levels, employing risk management techniques, and staying informed about market developments are essential for navigating the USDJPY market effectively.