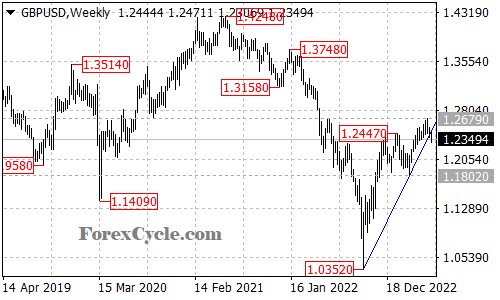

The GBPUSD currency pair has recently broken below a rising trend line on the weekly chart, indicating that a period of consolidation for the uptrend from 1.0352 is currently underway. This consolidation phase suggests a temporary pause in the upward momentum, with the pair likely experiencing some downward pressure in the near term.

Traders should anticipate the possibility of another fall towards the 1.1802 support level over the next several weeks. This downward movement is a natural part of the consolidation process and does not necessarily imply a reversal of the overall uptrend. It is important to approach this phase with caution and closely monitor price action for potential signs of a trend continuation or reversal.

On the upside, a significant resistance level lies at 1.2679. A break above this level would signal renewed strength in the uptrend and could trigger another rise towards the 1.3200 area. This would indicate that the consolidation phase has ended, and the pair is resuming its upward trajectory.

In conclusion, the GBPUSD pair is currently undergoing a consolidation phase within the context of its uptrend from 1.0352. Traders should anticipate the possibility of another fall towards the 1.1802 support level in the coming weeks. However, a break above the 1.2679 resistance level would indicate a resumption of the uptrend and could lead to further gains towards 1.3200. Staying informed, exercising caution, and adapting strategies to the evolving market conditions will be key to successfully navigating the GBPUSD pair during this consolidation phase.