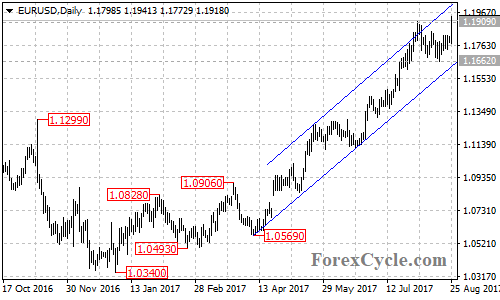

After consolidation, EURUSD extended its bullish movement to as high as 1.1941, suggesting that the uptrend from 1.0569 has resumed. Further rise could be expected in a couple of weeks, and next target would be at 1.2165 area. Key support is now at 1.1662, only a breakdown below this level could signal completion of the uptrend.