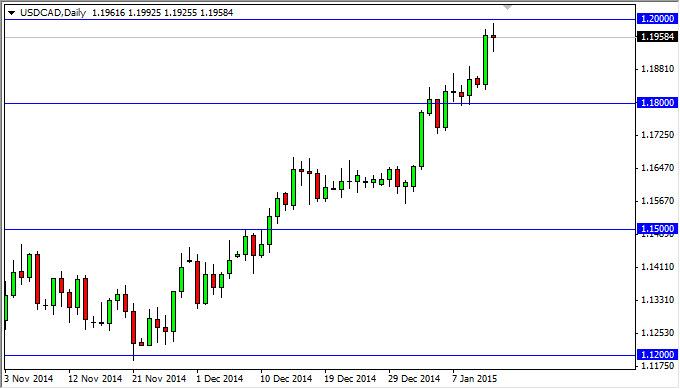

The USD/CAD pair went back and forth during the course of the session on Tuesday, showing the 1.20 level to be resistive still, and as a result we believe that the market is probably going to pull back. Because of this, we feel that the market will continue to be bullish but a pullback may be needed. If we break above the top of the 1.20 level though, we feel that this market could continue to go much higher. The 1.18 level below should be supportive, and as a result we are looking for some type of pullback that shows support on shorter time frames is the way we choose to enter this market in an ideal manner. Honestly, although we would buy the breakout above, it’s easier to look at the US dollar has being “on sale”, and purchasing it every time that it’s cheap.

We believe ultimately that this market goes much higher, because we have broken out on longer-term charts. The longer-term charts suggests that we could go as high as 1.25 given enough time, but this pair does tend to be quite a bit choppy and stubborn at times. This is because the two economies are so intertwined, so it makes sense that the currencies tend to go back and forth quite a bit, such as the Euro and the Pound do against each other.

Looking forward, the 1.16 level below is probably the “floor” in this market place, and the oil markets are simply collapsing. With that being the case, the oil markets simply are not going to support the Canadian dollar going forward, and as a result there’s no real reason to believe that this pair should fall with any significance in the near term. In fact, we believe that this is a longer-term uptrend that should continue for quite some time, and that perhaps the US dollar will continue to strengthen against its northern cousin for the next couple of years. Regardless, at this point time we’ll see any way of selling this pair now.