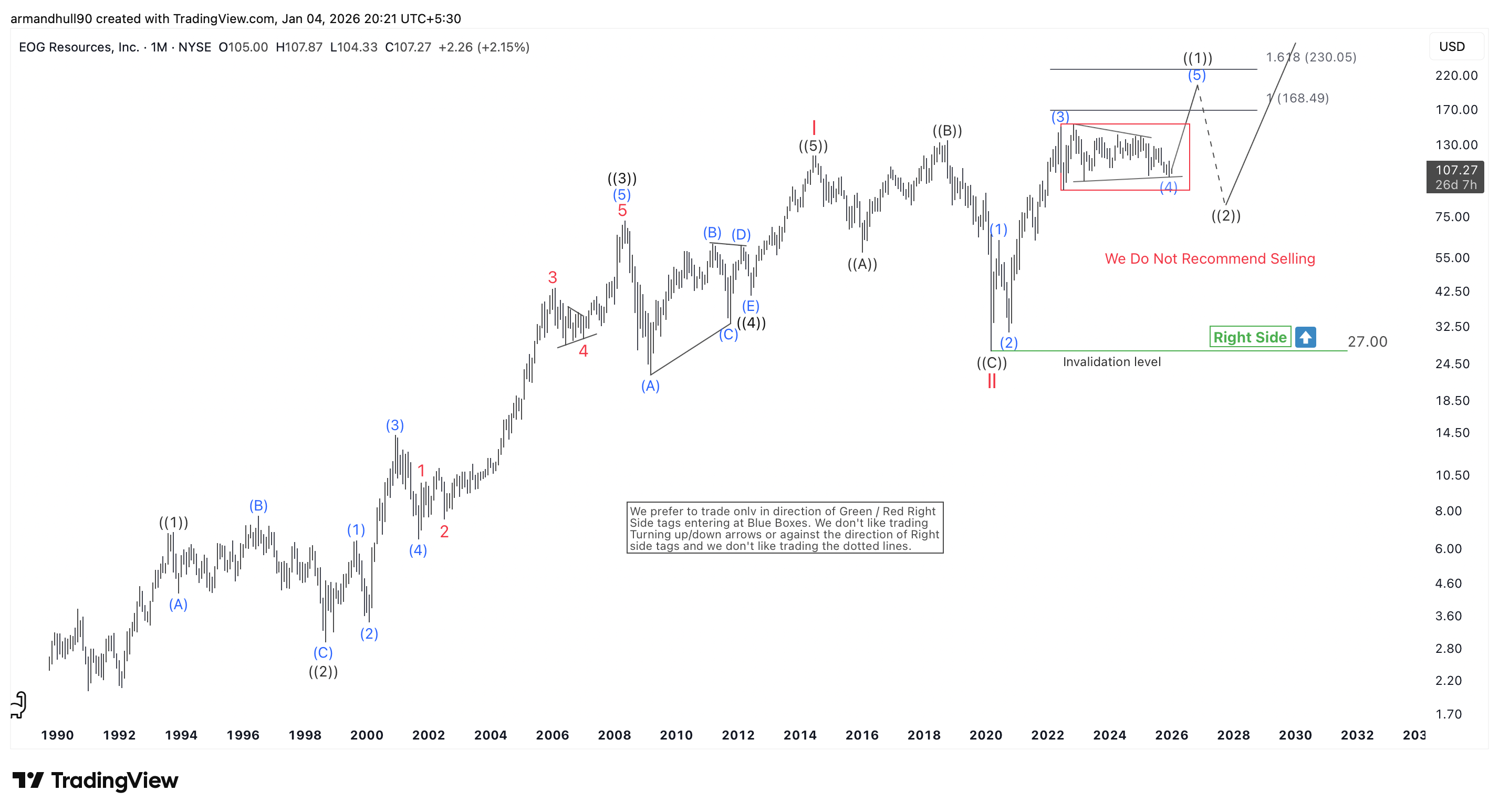

EOG consolidates inside a Wave (4) range in the very start of a powerful Wave III advance, with a bullish breakout pointing to higher Fibonacci targets.

EOG Resources, Inc. (NYSE: EOG) continues to trade within a strong long-term bullish Elliott Wave structure on the monthly chart. The broader trend remains firmly positive. Price action from the pandemic low confirms that the market has entered a powerful bullish phase rather than forming a long-term top.

The stock has already completed one full major market cycle. Red Wave I and red Wave II are now in place. After Wave II ended at the corona bottom, EOG started the most advanced and dynamic phase of the Elliott Wave sequence, which is Wave III. This phase usually delivers the strongest price expansion, and the structure from the 2020 low supports this view.

Range-Bound Structure at Current Levels & Fibonacci Targets Explained

The advance from the 2020 bottom is unfolding as a clear impulsive move. Inside this red Wave III, the internal wave structure shows an incomplete sequence marked in blue as waves (1), (2), (3), and (4). Waves (1) and (2) established the trend, while Wave (3) produced strong upside momentum. This behaviour matches the typical characteristics of a third wave. Wave (4) now appears to be either complete or still developing.

Price is consolidating in a range-bound manner inside the red rectangular box on the chart. This sideways movement reflects temporary balance between buyers and sellers. Such behaviour is common during fourth waves, which often form ranges or triangles instead of deep pullbacks.

Once price breaks higher, the final leg of this impulse, blue Wave (5), should begin. Fibonacci extension analysis helps define the upside targets. The first upside objective sits near 168.49. This level represents a common extension where price may pause or react. If momentum remains strong, the move can extend further. The next major Fibonacci target appears near the 1.618 extension at 230.05. Reaching this area would complete a full five-wave advance in black Wave ((1)). After this move, a corrective pullback is expected before the market resumes its broader bullish trend and continues higher again.

Conclusion:

In conclusion, EOG Resources remains firmly positioned within a powerful Wave III advance. The current range-bound movement reflects consolidation, not weakness. A confirmed breakout above the red box should open the door to higher Fibonacci targets, keeping the long-term bullish outlook intact.