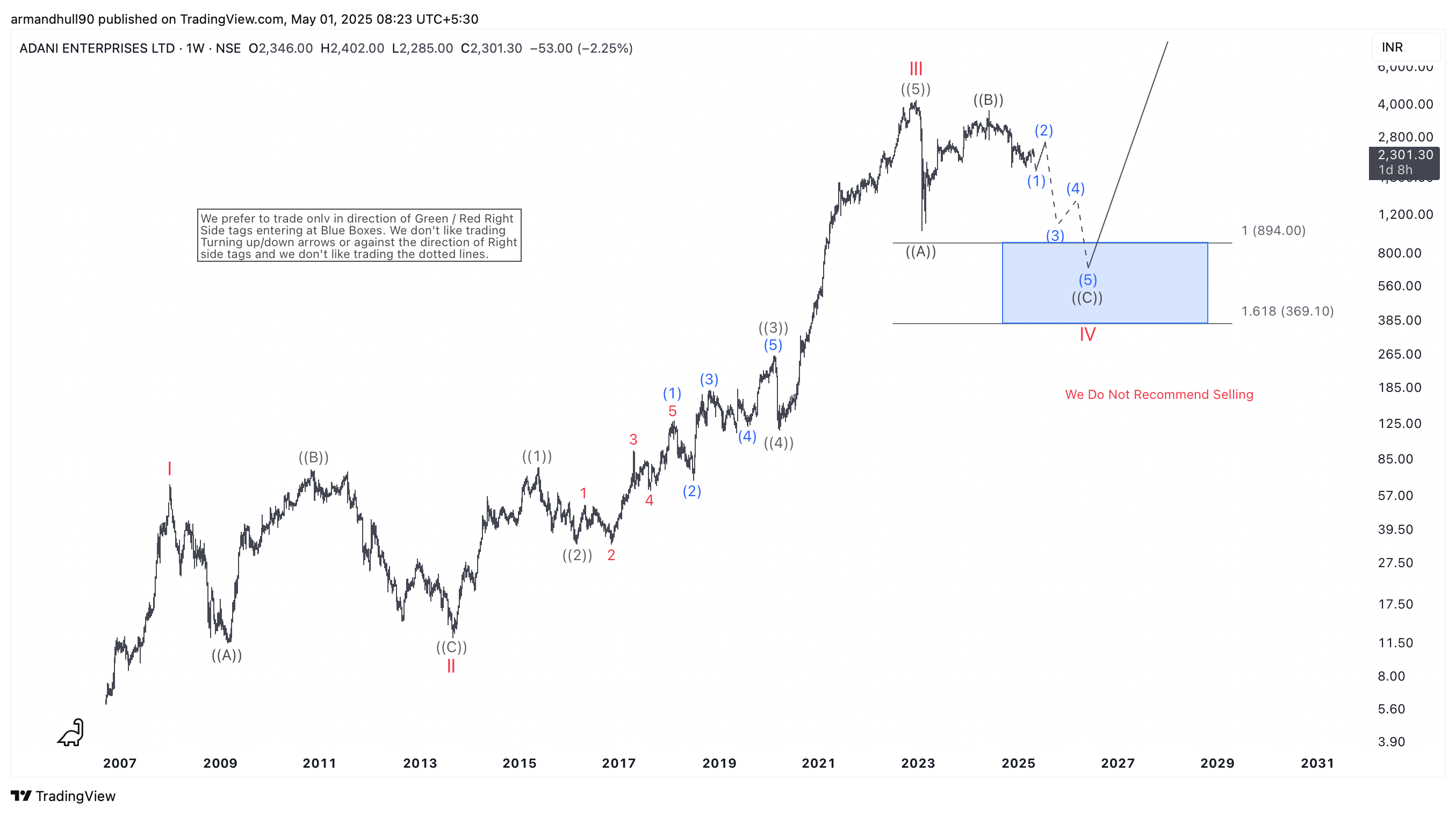

Adani Enterprises Elliott Wave Analysis: Wave IV Pullback Could Offer a Major Buying Opportunity

Adani Enterprises is undergoing a deep correction. Our Elliott Wave analysis suggests this is part of a higher-degree Wave IV pullback. The stock saw a strong rally in Wave III, which peaked in 2022. Since then, the price has been correcting in a three-wave structure labeled as ((A))-((B))-((C)).

We believe the Wave IV correction is not yet complete. Based on our analysis, we expect the stock to move lower within the ideal blue box area. This area lies between ₹894 and ₹369. The blue box marks a high-probability buying zone, where buyers may re-enter the market. The lower boundary of this box represents the 1.618 Fibonacci extension of wave ((A)).

So far, the correction appears impulsive. The internal structure of wave ((C)) is unfolding as a five-wave decline. We are about to completed sub wave (1) followed by a 3, 7 or 11 swings pull back. While the pull back in (2) remains below the recent top, we could expect it to extend lower in wave (3) following (4) and one final push lower in wave (5) would ideally complete the entire correction.

Once wave IV is complete, we expect Adani Enterprises to resume its long-term uptrend in wave V. Our long-term outlook remains bullish, and we do not recommend selling. Instead, we advise patience and discipline while waiting for the blue box zone to be reached.

At Elliott Wave Forecast, we trade in the direction of the Right Side tags. Currently, the long-term Right Side tag remains bullish. This supports our expectation for another strong rally after this correction ends.

Summary:

In summary, the current correction offers an opportunity. A move into the blue box area may present a low-risk, high-reward trade setup for the next bullish cycle.