Hello fellow traders. In this technical article we’re going to take a look at the Elliott Wave charts charts of USDJPY published in members area of the website. As our members know USDJPY has recently made pull back that has unfolded as Elliott Wave Double Three Pattern. It made clear 7 swings from the November 13th peak and completed correction right at the Equal Legs zone . In further text we’re going to explain the Elliott Wave pattern and forecast

Before we take a look at the real market example, let’s explain Elliott Wave Double Three pattern.

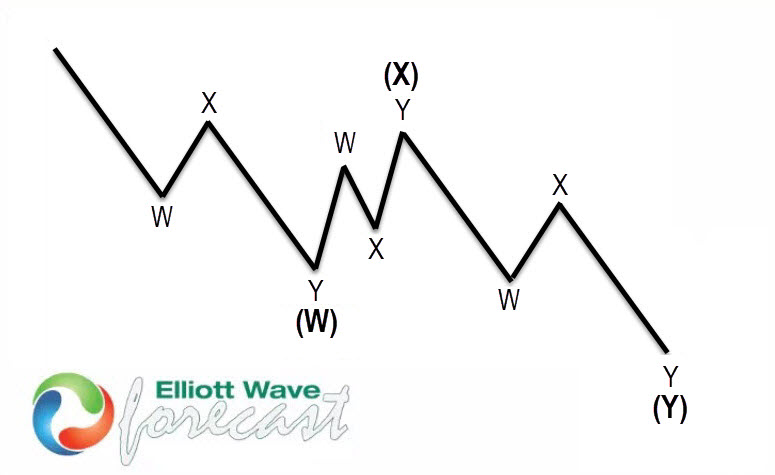

Elliott Wave Double Three Pattern

Double three is the common pattern in the market , also known as 7 swing structure. It’s a reliable pattern which is giving us good trading entries with clearly defined invalidation levels.

The picture below presents what Elliott Wave Double Three pattern looks like. It has (W),(X),(Y) labeling and 3,3,3 inner structure, which means all of these 3 legs are corrective sequences. Each (W) and (Y) are made of 3 swings , they’re having A,B,C structure in lower degree, or alternatively they can have W,X,Y labeling.

USDJPY H4 Update 11.20.2023

USDJPY is doing correction that is unfolding as a 7 swings pattern. Pull back has (W)(X)(Y) blue labeling. First leg (W) is having Zig Zag Structure – 3 waves ABC red, while (Y) leg can be WXY Double Three Pattern. The structure is still incomplete at the moment. The pair is showing lower low sequences from the 151.89 peak. We expect to see another leg down toward extreme area: 147.26-146.62 ( buying zone). Once USDJPY reaches proposed extreme zone, we expect the pair to make a rally toward new highs or in 3 waves bounce alternatively.

You can learn more about Elliott Wave Double Three Patterns at our Free Elliott Wave Educational Web Page.

USDJPY H4 Update 11.21.2023

The pair found buyers at the Equal Legs Area . It made nice rally from the zone which looks to be impulsive. Bounce already reached 50 fibs against the (X) blue connector which confirms cycle from the peak is done for sure. Consequently, any long positions from the equal legs area should be risk free by now. As far as the price stays above 147.13 low, we can consider correction completed and see further strength in the commodity.

Keep in mind not every chart is trading recommendation. You can check most recent charts and new trading setups in the membership area of the site. Best instruments to trade are those having incomplete bullish or bearish swings sequences. We put them in Sequence Report and best among them are shown in the Live Trading Room.

Source: https://elliottwave-forecast.com/elliottwave/usdjpy-elliott-wave-double-three/