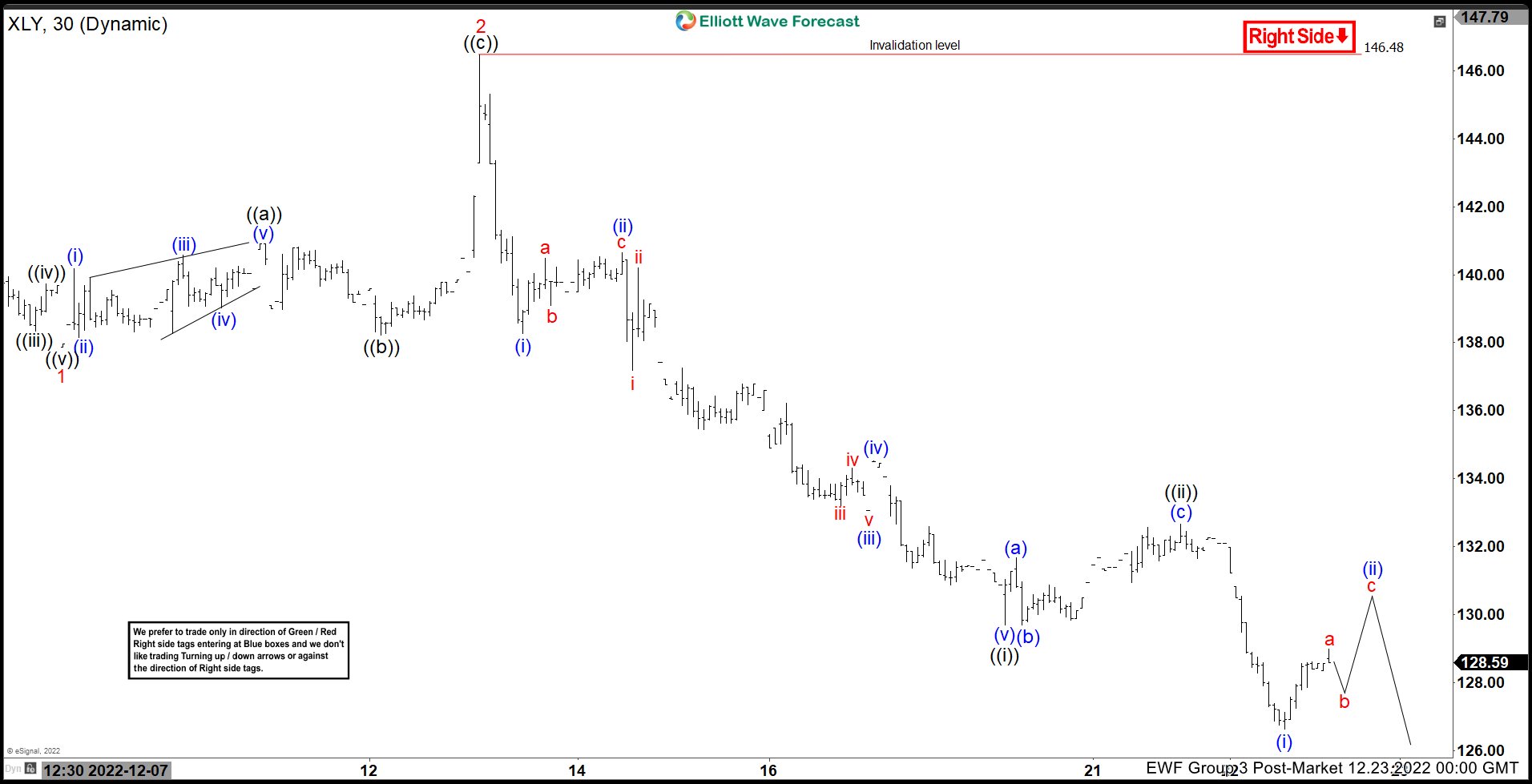

Hello Everyone! In this technical blog, we are going to take a look at the Elliott Wave path in Consumer Discretionary ETF ($XLY). We keep telling members that $XLY is showing an incomplete bearish sequence in the higher timeframes and any rallies can be sold in 3 or 7 swings at blue boxes for more downside.

$XLY 1H Elliott Wave Analysis Dec 21 2022:

The ETF has made 5 waves from 12.13.2022 peak at $146.48 and ended the cycle. We advised members to sell the bounce in 3 or 7 swings at black ((ii)) targeting more downside.

$XLY 1H Elliott Wave Analysis Dec 23 2022:

The ETF’s bounce failed in 3 waves and made a new low below ((i)) as expected. Any sellers are now risk free and should continue to hold for more downside. Right now, we keep pushing it lower in 3 or 7 swings at blue box areas against black ((ii)) connector. As our members know, Blue Boxes are no enemy areas , giving us 85% chance to get a reaction.

Source: https://elliottwave-forecast.com/stock-market/xly-forecasting-decline-selling-rallies-blue-box/