In this technical blog we’re going to take a look at the Elliott Wave charts charts of Russell $RTY_F published in members area of the website. Recently the Index corrected the cycle from the 9th June peak , when recovery unfolded as Elliott Wave Flat structure. In further text we’re going to explain the forecast and Elliott Wave Pattern.

Before we take a look at the real market example of Expanded Flat, let’s explain the pattern in a few words.

Elliott Wave Expanded Flat Theory

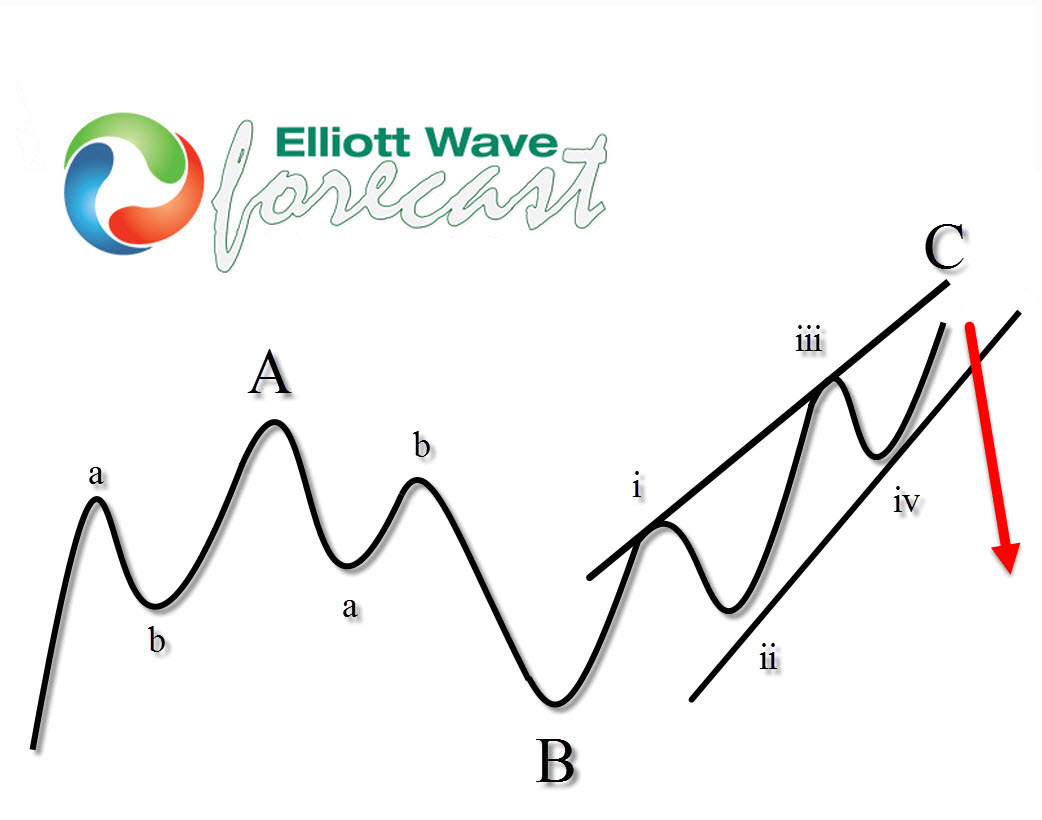

Elliott Wave Flat is a 3 wave corrective pattern which could often be seen in the market nowadays. Inner subdivision is labeled as A,B,C , with inner 3,3,5 structure. Waves A and B have forms of corrective structures like zigzag, flat, double three or triple three. Third wave C is always 5 waves structure, either motive impulse or ending diagonal pattern. It’s important to notice that in Flat Pattern wave B is very deep, but completes above the start point of wave A. Wave C ends above the ending point of wave A . Wave C of Flat completes usually between 1.00 to 1.236 Fibonacci extension of A related to B, but sometimes it could go up to 1.618 fibs ext.

At the graphic below, we can see what Expanded Flat structure looks like.

Now, let’s take a look what Elliott Wave Flat Pattern looks like in the real market

Russell 4Hour Elliott Wave Analysis 8.31.2021.

Russell is correcting the cycle from the June peak. Short term recovery X red looks to be unfolding as Elliott Wave Flat Pattern. As we can see on the chart below, waves ((a)) and ((b)) are showing corrective sequences. At this stage we expect to see more short term strength to complete 5 waves up from the recent low which would be ((c)) leg of X red Flat recovery. Recovery can be ending at 2270-2309.4 area, which is 1.00-1.236 fib extension of ((a))-((b)) .

You can learn more about Elliott Wave FLAT Patterns at our Free Elliott Wave Educational Web Page

Russell 4Hour Elliott Wave Analysis 9.20.2021.

Recovery made 5 waves in ((c)) leg and completed Elliott Wave Flat Structure at 2312.5 high. As far as the price stays below that high, Russell can be giving us next leg down. We expect further separation from the current 2312.5 peak and ideally break of 07/19 lw low which will confirm next leg down is in progress.

Keep in mind that market is dynamic and presented view could have changed in the mean time. You can check most recent charts in the membership area of the site. Best instruments to trade are those having incomplete bullish or bearish swings sequences. We put them in Sequence Report and best among them are shown in the Live Trading Room.

Elliott Wave Forecast