USDCHF found a low on 1.16.2020 (0.9610) and has been bouncing since then. Initial rally from 0.9610 to 0.9729 was in 3 waves which was followed by a pull back and pair has since then made a new high above 0.9729 and today, we would look at the structure of the bounce from 0.9610 and how this bounce fits into the bearish 5 swings incomplete sequence down from April 2019 peak that we mentioned in this article. Before we proceed to take a look at the structure of the bounce up from 0.9610 low, let’s revisit sequence lower from April 2019 peak.

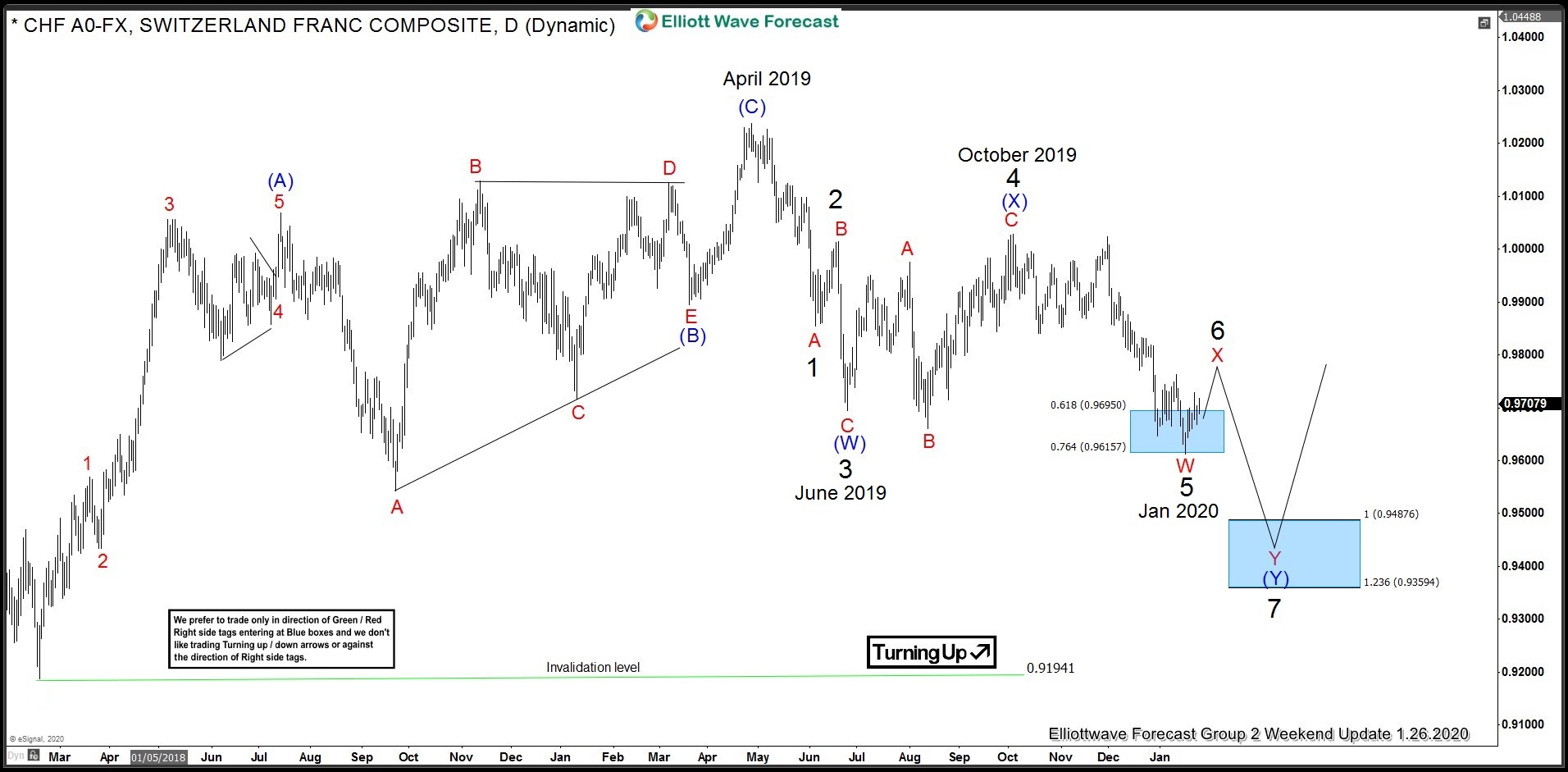

USDCHF Daily chart showing 5 swings Incomplete Elliott Wave Sequence

Chart below shows the decline from April 2019 to June 2019 peak was in 3 swings. This was followed by a FLAT correction higher to October 2019 peak. Since then pair has dropped to a new low below June 2019 low which makes it 5 swings incomplete sequence down from April 2019 peak with 5th swing ended in January 2020 at 0.9610. Pair is currently bouncing in 6th swing and as the decline from April 2019 peak is overlapping and hence not impulsive, expectations are for the current bounce to prove to be swing number 6 and produce another drop as swing 7 toward 0.9487 – 0.9359 to complete the swing sequence down from April 2019 peak. Once 7 swings sequence has completed, pair should see a larger 3 waves bounce at least.

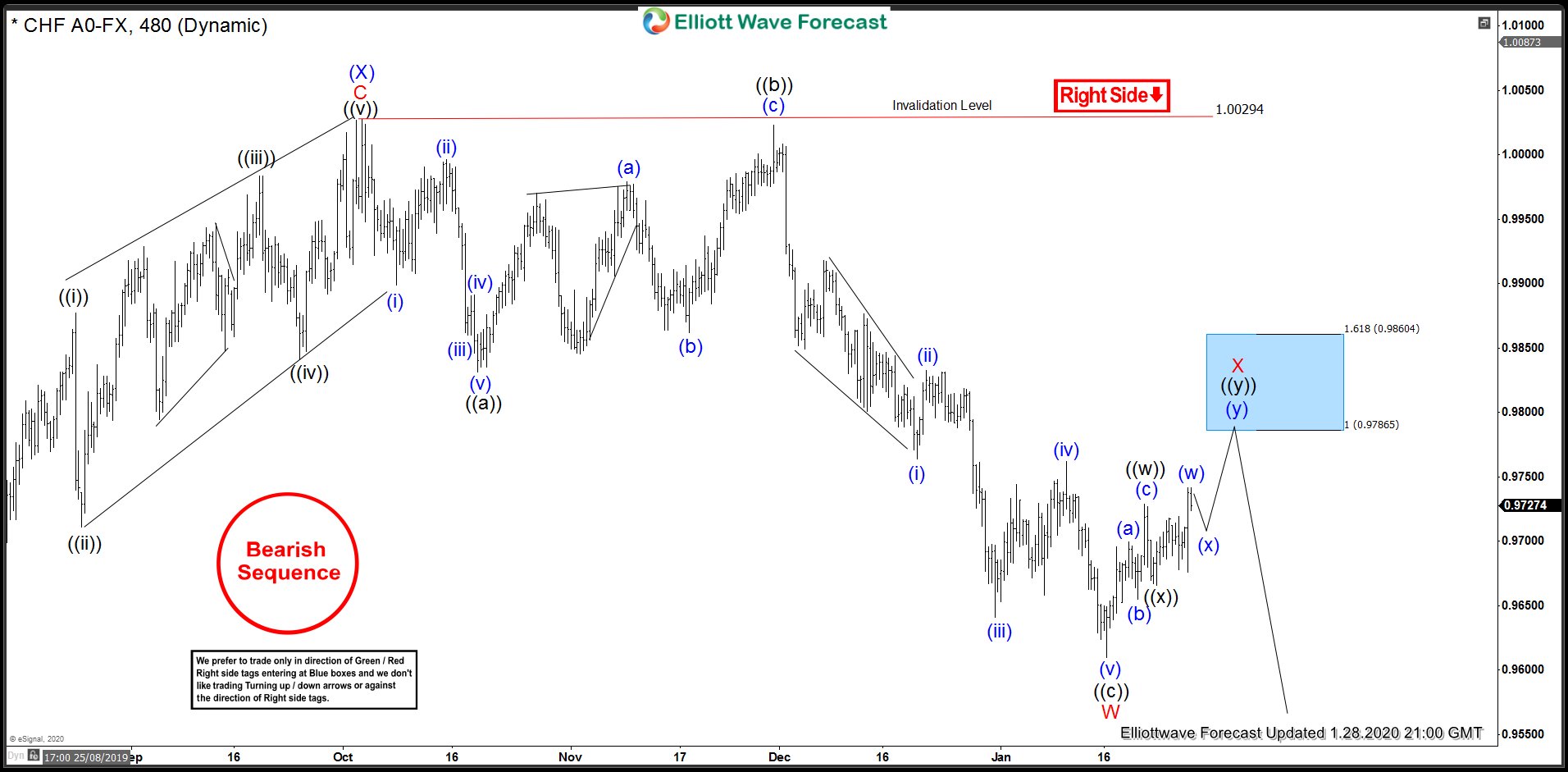

USDCHF Bounce from January 16, 2020 low

In the chart below we can see that the bounce from January 16, 2020 low is unfolding as a double three Elliott wave structure where the rally from 0.9610 to 0.9729 was in 3 waves i.e. wave ((w)). This was followed by a pull back in 3 waves to 0.9666 and since then pair has already made a new high above 0.9729 which makes it 5 swings up from 0.9610 low. Thus, as dips stay above 0.9666 low, pair is expected to make another push higher to complete 7 swings up from 0.9610 low. 0.9786 – 0.9860 is the ideal area to complete 7 swings up from 0.9610 low. Sellers should be waiting in this area and resume the decline for a new low below 0.9610 low or produce 3 waves pull back and do 11 swings higher or do a larger double three correction to the upside. Since the sequence is bearish so far as October 2019 (1.0029) peak remains intact, sellers should remain in control in 7 or 11 swings.