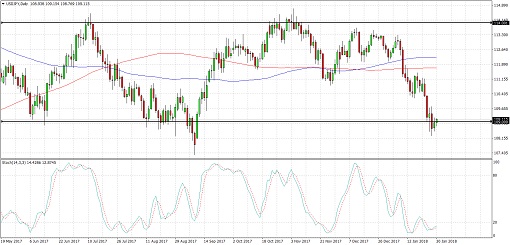

USDJPY has been moving back and forth inside a range with support at the 109.00 major psychological level and resistance at 114.00. Price is currently testing support and might be due for another bounce back to the top or halfway there.

Stochastic is already indicating oversold conditions and turning higher to signal a pickup in bullish pressure. A slight bullish divergence can be seen as price made lower lows while the oscillator had higher lows since January 12.

The 100 SMA is above the longer-term 200 SMA to signal that the path of least resistance is to the upside, which suggests that support is more likely to hold than to break. Still, a move lower could lead to a drop of around 500 pips or the same height as the rectangle pattern.

The dollar rebounded against most of its counterparts in recent trading sessions as global tightening expectations picked up on remarks from a few central bank officials. Economic data turned out mostly upbeat, with the core PCE price index rising from 0.1% to 0.2% and the personal income figure up by 0.4% versus the 0.3% forecast. Personal spending, however, fell short at 0.4% versus the 0.5% consensus.

In Japan, data was weaker than expected. Household spending is down 0.1% on a year-over-year basis instead of the estimated 1.6% figure and the earlier 1.7% increase. The unemployment rate also ticked up from 2.7% to 2.8% but this was mostly due to an increase in the labor force and in the participation rate.

The US CB consumer confidence index is due today but the focus could be on the FOMC decision and NFP release later on. Most market analysts appear doubtful that the dollar bounce could last, although it could hinge on sentiment and bond yields from here.

By Kate Curtis from Trader’s Way