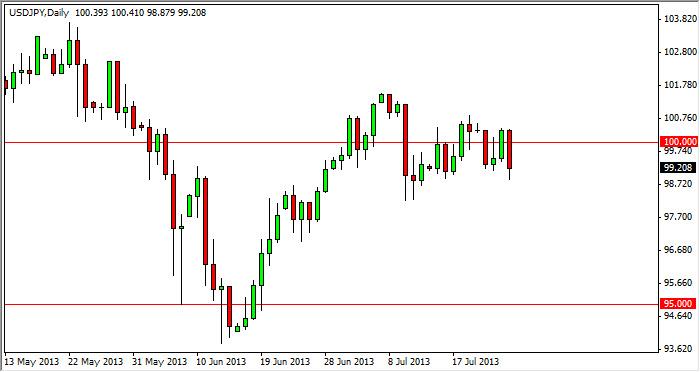

The USD/JPY pair fell hard during the session on Thursday, slamming into the 99 handle. However, we got a little bit of a bounce towards the end of the day, and this of course would be expected. However, this market is essentially in the middle of consolidation, with an emphasis on the 100 handle. Because of this, we feel that this market is trying to build up enough upward momentum in order to continue higher.

The Bank of Japan continues to work against the value of the Yen, and a lot of what is pushing this market around will be expectations on whether or not the Federal Reserve is going to taper off of quantitative easing. If they do, then you can expect the US dollar to continue gaining value, and that will be especially true in this pair as the Bank of Japan is just starting its quantitative easing cycle, which looks to be rather large, and more than likely rather lengthy.

That being the case, we still find this pair as one that we only buy, we have no plans to sell obviously. There is a significant amount of support somewhere near the 98 handle as well, but we also see that there is a “floor” in this marketplace down at the 95 handle. If we managed to get below that level, we believe that the Bank of Japan would in fact get involved in this pair yet again.

The markets know this, and as a result we think that this pair can only fall so far. Pay attention to the interest rate differential between the two countries and their 10 year notes, as that is one of the biggest drivers of this pair most of the time. If we can get above the highs from the session on Wednesday and Thursday, we think that the market will start heading towards the 102 level, followed quickly by the 103 and 105 levels. Again, we think there are absolutely too many reasons not to short this market, and look at any pullback at this point in time as a potential buying opportunity.

Written by FX Empire