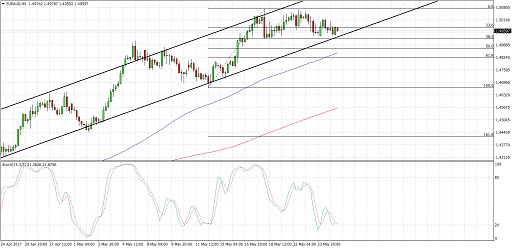

EURAUD is still moving safely inside its short-term ascending channel and has recently pulled back to support again. Applying the Fib tool on the latest swing low and high shows that the channel bottom lines up with the 50% Fibonacci retracement level near the 1.4900 major psychological mark.

The 100 SMA is above the longer-term 200 SMA on the 1-hour chart so the path of least resistance is still to the upside. In addition, the 100 SMA is moving close to the Fibs and channel support, adding to its strength as a potential floor. Also the gap between the moving averages is widening to reflect stronger bullish pressure.

Stochastic seems to be climbing out of the oversold region to suggest a return in bullish pressure. If you’re waiting for more confirmation, a break past the small descending triangle resistance around 1.4950 could be indicative of upside momentum.

Moody’s recently downgraded China’s outlook from “stable” to “negative” on forecasts of eroding financial strength and slowing growth. The credit rating agency noted that rising government debt levels won’t be enough to keep overall economic performance supported, signaling even weaker demand for Australia’s commodity exports down the line.

There are no reports due from Australia for the rest of the week so market sentiment could push AUD around. In the euro zone, PMI readings have been mostly stronger than expected while business and consumer sentiment figures from Germany have indicated improvements. French and German banks are closed for the holiday today.

By Kate Curtis from Trader’s Way