In this technical blog, we will look at the past performance of the 1-hour Elliott Wave Charts of SPY. We presented to members at the elliottwave-forecast. In which, the rally from the 21 November 2025 low is unfolded as an impulse structure. Also showed a higher high sequence suggested that ETF should see more upside extension to complete the impulse sequence. Therefore, we advised members not to sell the ETF & buy the dips in 3, 7, or 11 swings at the blue box areas. We will explain the structure & forecast below:

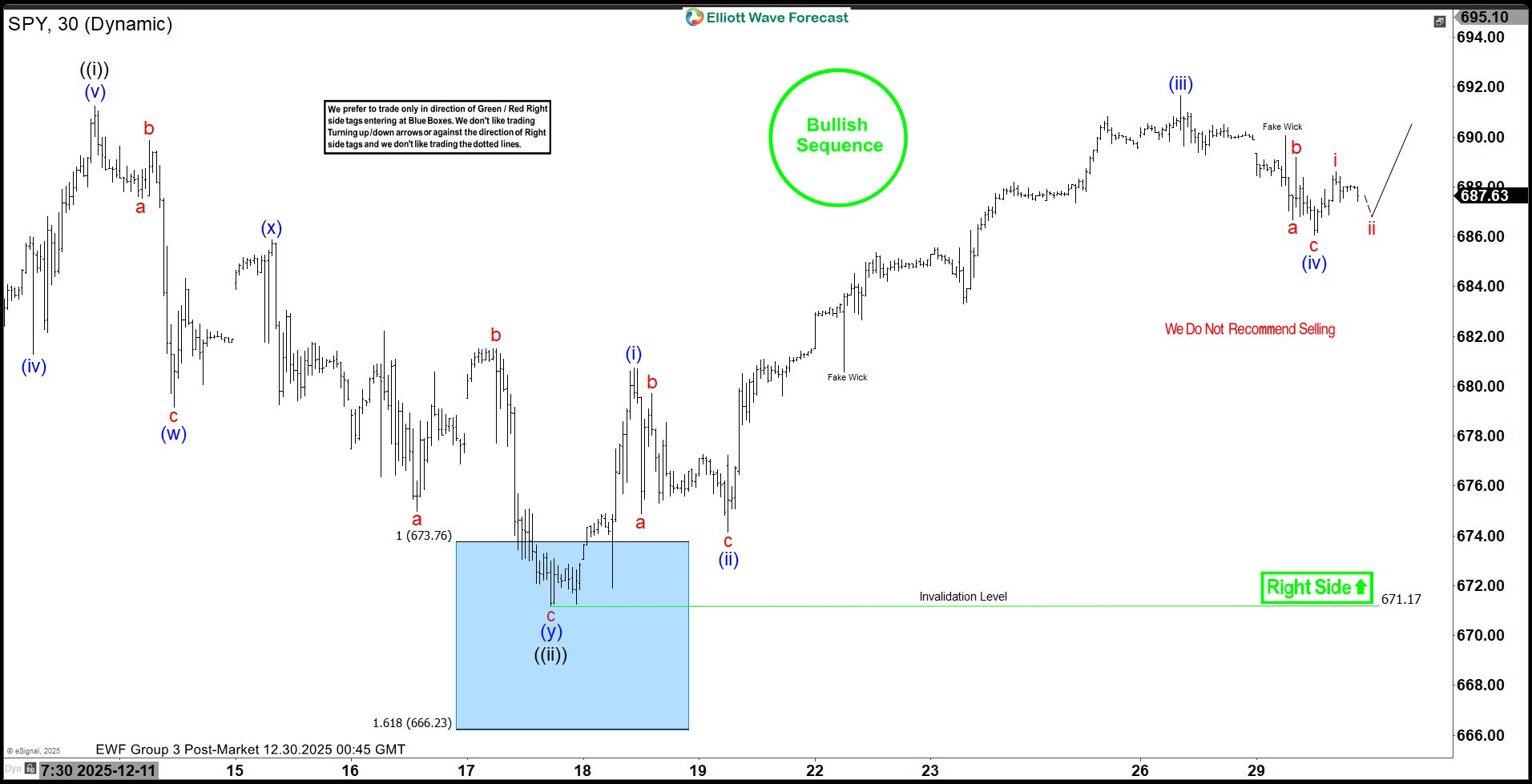

SPY 1-Hour Elliott Wave Chart From 12.17.2025

Here’s the 1-hour Elliott wave chart from the 12.17.2025 Post-Market update. In which, the short-term cycle from the 11.21.2025 low ended in wave ((i)) as impulse at $691.24 high. Down from there, the ETF made a pullback in wave ((ii)) to correct that cycle. The internals of that pullback unfolded as Elliott wave zigzag structure where wave (a) ended at $679.17 low. Wave (b) bounce ended at $685.87 high. Then wave (c) managed to reach the blue box area at $673.73- $649.45. From there, buyers were expected to appear looking for the next leg higher or for a 3 wave bounce minimum.

SPY Latest 1-Hour Elliott Wave Chart From 12.30.2025

This is the 1-hour Elliott wave Chart from the 12.30.2025 Post-Market update. In which the ETF is showing a reaction higher taking place, right after ending the correction within the blue box area. Allowed members to create a risk-free position shortly after taking the long position at the blue box area. Since then, SPY has already made a new high targeting $712.96- $722.81 area higher minimum before profit taking & next pullback takes place in 3, 7 or 11 swings.

Source: https://elliottwave-forecast.com/bluebox-wins/spy-confirms-elliott-wave-mastery-blue-box-rally/