In this technical blog, we are going to take a look at the performance of past Elliott wave FTSE charts from April 2017. Now lets take a look at the 4 hr chart from April 20,2017, which is showing the intermediate cycle in wave (A) in blue unfolded on March 17,2017 peak 7448, below from there intermediate pullback in wave (B) in blue was proposed be in progress as Elliott wave Flat structure. Where Minor wave A in red unfolded in 3 swings (labelled as W,X,Y structure) at 7251 and wave B in red also unfolded in 3 swings (labelled as W,X,Y structure) at 7404 peak. Below from there Minor wave C in red of a flat remained in progress and already showing the enough number of swings within the buying area from the peak. However another marginal push lower was expected within the blue box area (7100-7027) area to complete there as 5 waves structure.

FTSE 4 hour chart

Then we got the nice reaction higher from the mentioned blue box area as expected thus suggesting the intermediate cycle in wave (X) pullback should be completed as Flat structure at 7098 low and allowing buyers to create a risk free position in the trade. Also the bounce from 7098 low looks to be unfolding as continuation pattern i.e. Elliott wave Zigzag pattern, where index was expected to trade higher towards 7403-7452 equal legs area of ((a))-((b)) next as far as pivot from 7098 low remains intact.

1 Hour FTSE Elliott Wave Chart

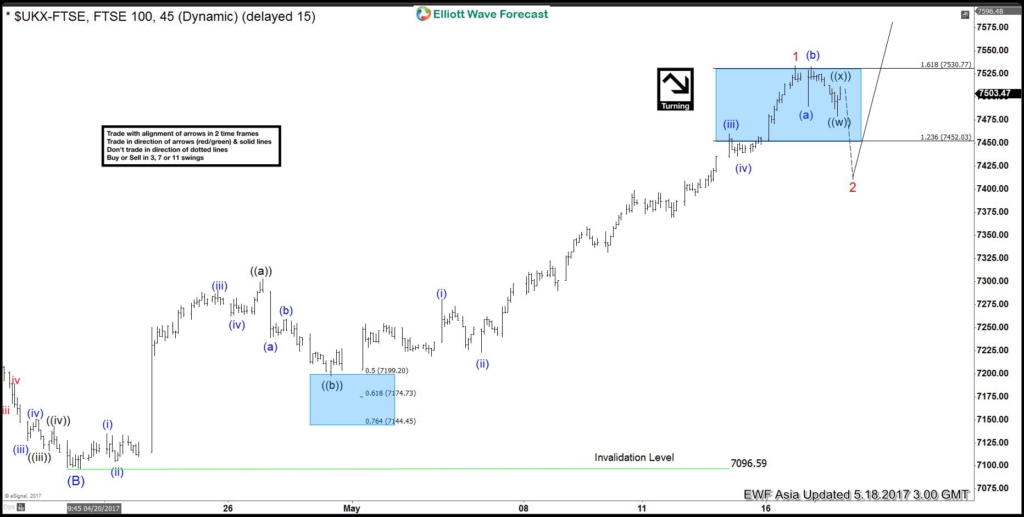

Since then index rallied as expected & has broken above the March 17,2017 peak 7448 already thus suggesting the next leg higher has already started. Index then did a full retest of 1.618% extension area of ((a))-((b)) 7530 before ending the cycle from 7098 low in Minor wave 1 and started the pullback in Minor wave 2 that should expected to find buyer’s against 7098 low in sequence of 3, 7 or 11 swings for further upside.

1 Hour FTSE Elliott Wave Chart

The index already did a 3 swings pullback in Minor wave 2, so the correction of cycle from 7098 low could be done in the index at yesterday’s low 7389, while above there and more importantly as far as pivot from 7098 low remains intact index has scope to resume the rally again.

FTSE Latest 1 Hour Chart

Keep in mind that the market is dynamic and the view could change in the mean time. Success in trading requires adequate risk and money management, as is the understanding of Elliott Wave theory, cycle analysis and correlation. We have developed a very sensitive trading strategy that defines entry, stop loss and take profit levels with high accuracy and allows you to take risk free position shortly after taking it by protecting your wallet.

Source : https://elliottwave-forecast.com/stock-market/ftse-rallied-after-ending-elliott-wave-flat