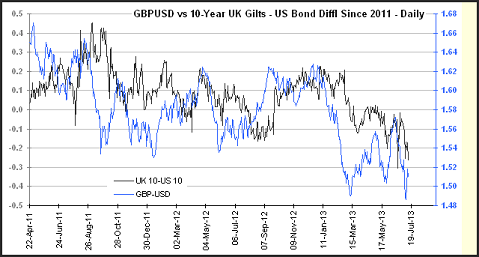

The change in the yield differential which has been altered over the last couple of trading session has allowed the sterling to hold support levels, in the face of a strong dollar which could now face continued economic headwinds. The recent runup of more than 100 basis points in the 10-year space on US yields was the driving force behind recent dollar strength. There are a number of key UK data points that are scheduled to be released this week that could again alter the course of the pound.

The UK-US 10-year yield differential has been falling in the dollars favor but today’s reversal after a worse than expected US retail sales report, has helped the pound gain traction. The yield differential now favors the US and show that investors can earn yield by holding the US over the UK. UK yields have declined significantly over the past two weeks moving down by nearly 30 basis points in the 5-year sector.

US data was softer than expected which allowed US yields to move lower. According to the Commerce Department, US retail sales increased by .4% in June compared to the .8% expected by economists. Excluding auto’s retail sales declined by .1%. Sales were driven by strong automobile sales and increasing volumes of gasoline sales. The retail sales figure reflects consumer spending and sentiment and is a direct input into US GDP. GDP expectations have been revised lower down below the 1% level post the release of the retail sales number.

UK data economic data has also been soft post the recent Bank of England interest rate meeting which generated a test of the recent lows near 1.48. Looking forward there is a number of key inflation data points scheduled to be released during the week. On Tuesday the markets will see the UK CPI report, which will be followed by the PPI on Wednesday and retail sales on Thursday. The meeting minutes which will describe the interaction with new BoE head Mark Carney will also give investors insight into future guidance from the UK central bank.

Sterling initially tested support levels early in the European trading session near the May lows at 1.5008, but was able to recapture support near the 10-day moving average near 1.5063. Resistance on the currency pair is seen near 1.5210. (chart courtesy of Intertrader)

Momentum on the GBP/USD is flattening as the index hovers near the zero index level. The spread (the 12-day moving average minus the 26-day moving average) is printing on top of the 9-day moving average of the spread. The RSI (relative strength index) is also reflecting consolidation printing near 44, which is in the middle of the neutral range.

Sterling will be driven by Bernanke’s testimony, which is likely to be dovish which will help the sterling gain traction. The market still has tapering baked into the value of the dollar, which could come out with additional dovish comments from Bernanke.