The GBP/USD pair fell hard on Friday as the world’s traders sold off risk in general. The Chinese GDP numbers fell flat, and people took risk off going into the weekend as a result. However, the reaction may have been a bit overdone as the release was still 8.1%!

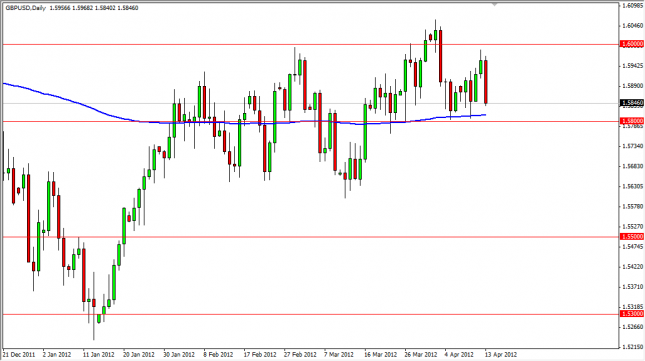

The 1.58 level is an obvious support area that this market respects. It is also the site of the 200 day exponential moving average now, and this will give it even more clout with the market. However, the upside is protected up to the 1.650 level, and as a result we have a very tight market at the moment.

The pair does look a bit tired at the moment, but the reality is that we need to see a break of one of these levels in order to actually trade form more than a scalp at the point in time. The market looks to be the domain of those who are willing to aim for ultra short-term gains. The pair will continue to be influenced by headlines from around the world, and will simply trade like a “risk barometer” going forward. Because of this, it will be a difficult market to be in until some kind of clarity comes back.

The moving average is fairly benign looking, as it is flat. Perhaps it is that reason that the market is simply grinding sideways at the moment. With that in mind, it is very difficult to get too excited in one direction or another for the time being, but rather much more comfortable to simply wait for the market to tip its hand first by breaking up or down. The market will continue to be back and forth, but the problems in Europe could be the tipping point. Remember, the British send over 40% of their imports go to Europe. With this being said, it is sometimes much safer to step back and let the market make the markets tell you which direction to go first before putting any real money to work in this pair.

Written by FX Empire