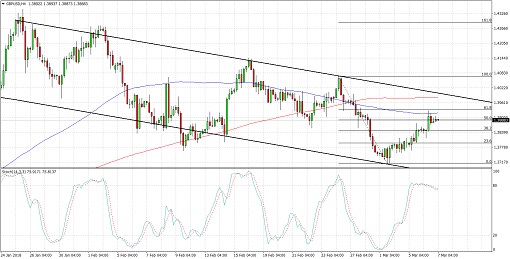

Cable is trending lower inside a descending channel on its 1-hour time frame and looks prime for a pullback. Price is currently testing the 50% retracement level at the 1.3900 major psychological level and could head back down to the swing low or the channel support around 1.3650-1.3700 soon.

A larger pullback could last until the 61.8% Fib closer to the channel resistance at the 1.3950 minor psychological level. This is also close to the 200 SMA dynamic resistance.

Stochastic looks ready to turn south to show a return in bearish pressure. The 100 SMA is also below the longer-term 200 SMA, which confirms that the path of least resistance is to the downside or that the selloff could continue.

There were no major reports out of the UK yesterday and PM May’s recent speech on Brexit has been somewhat reassuring, allowing sterling to regain some ground. Also, the services PMI beat expectations with a climb from 53.0 to 54.5 earlier this week.

As for the dollar, fears of a trade war or retaliation from other nations on Trump’s plans to impose higher tariffs on steel and aluminum imports have been a bearish factor. Although government officials tried to give some words of reassurance earlier in the US session, the resignation of economic adviser Gary Cohn revived trade concerns.

Cohn has been instrumental in maintaining diplomatic trade relations, despite tension with China, Canada, and Mexico. His resignation could leave stronger protectionist sentiment in the White House, which would prove bearish for the dollar.

By Kate Curtis from Trader’s Way