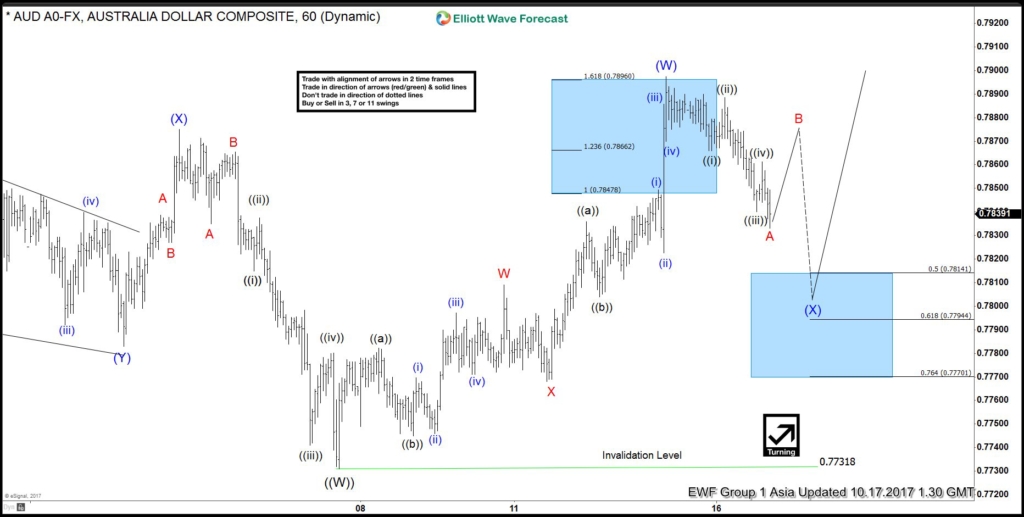

AUDUSD Short term Elliott Wave analysis suggests decline to 0.7731 ended Primary wave ((W)) on 10/6 low. Bounce in Primary wave ((X)) is proposed to be unfolding as a double three Elliott Wave structure. Intermediate wave (W) of ((X)) ended at 0.7897 and Intermediate wave (X) of ((X)) pullback is in progress as a zigzag Elliott Wave structure. Down from 0.7897 high, Minor wave A is proposed complete at 0.7832. While Minor wave B bounce stays below 0.7897, pair should turn lower in Minor wave C of (X) to correct cycle from 10/6 low. Afterwards, as far as pivot at 10/6 low (0.7731) stays intact, expect pair to resume higher.

AUDUSD 1 Hour Elliott Wave Chart

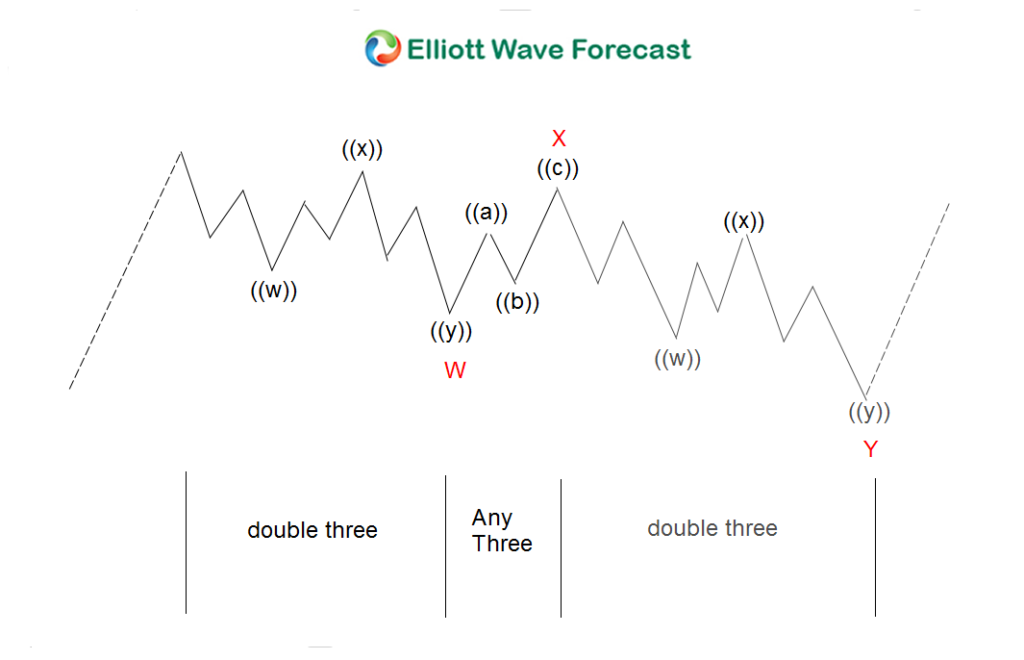

Double three ( 7 swings) is the most important pattern in Elliott wave’s new theory. It is also probably the most common pattern in the market these days. Double three is also known as a 7-swing structure. It is a very reliable pattern that gives traders a good opportunity to trade with a well-defined level of risk and target areas. The image below shows what Elliott Wave Double Three looks like. It has labels (W), (X), (Y) and an internal structure of 3-3-3. This means that all 3 legs has corrective sequences. Each (W) and (Y) is formed by 3 wave oscillations and has a structure of A, B, C or W, X, Y of smaller degrees.

Source : https://elliottwave-forecast.com/forex/audusd-short-term-elliott-wave-analysis/