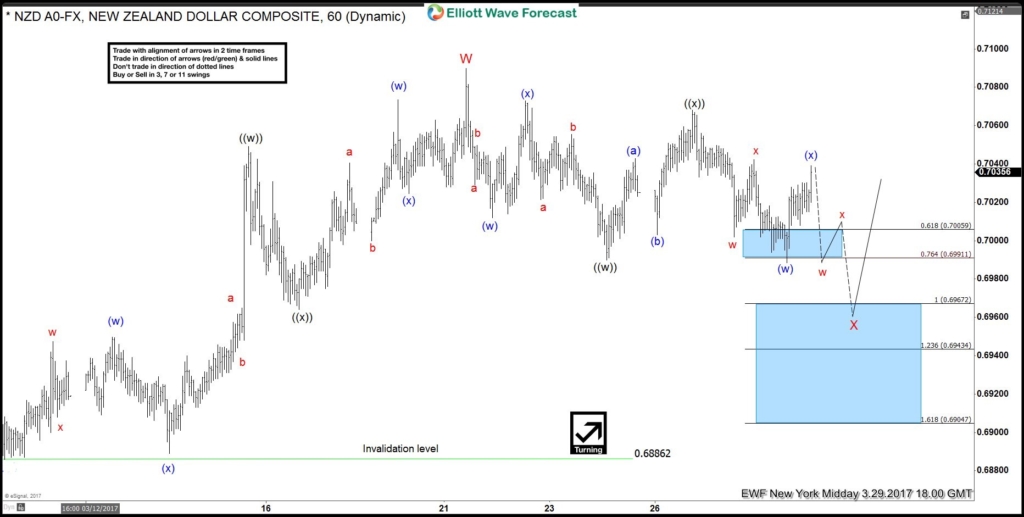

1 Hour Elliott Wave Analysis: NZDUSD is currently in a Elliott Wave double ((w))-((x))-((y)) correction lower on the 1 hour timeframe and we expect red wave X to terminate in the 0.6967 – 0.6943 area where the pair should bounce higher. We do not recommend selling the pair to the proposed red wave X terminating area but rather recommend buying in that area for the next possible move higher. The bullish scenario is invalid if price moves below the 0.6886 level.

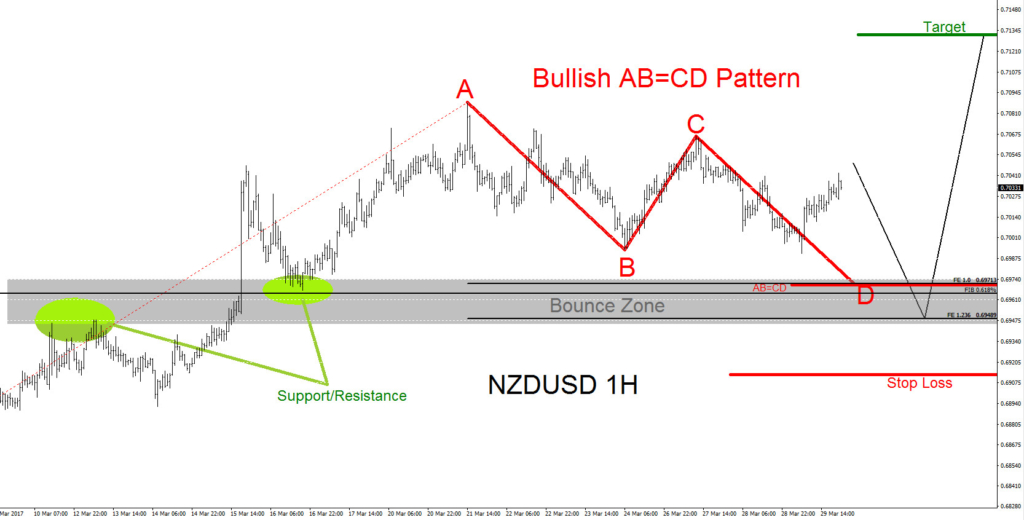

1 Hour Bullish Pattern: A possible Bullish Pattern (Red) is clear and visible on the 1 hour chart. The red bullish pattern Point D terminates near the 0.618% Fib. retracement and the 1.0 (Equal legs) Fib. extension levels. Also looking back at previous price action we can also see there is a support/resistance zone where price has bounced off. Putting all this together with the above Elliott Wave (chart above) we believe the Bounce Zone (Grey box) will provide good support and NZDUSD should bounce higher off this zone if price reaches this area.

If looking to buy NZDUSD traders should be patient and wait for the 1 hour red point D/wave red X pullback to the possible bounce zone (grey box). Waiting for the red point D/wave red X pullback/retrace to the possible bounce zone will offer a better risk/reward trade setup. Stop loss should be placed at 0.6910. Below 0.6910 will invalidate the red bullish pattern. Target is at 0.7130

Of course, like any strategy/technique, there will be times when the strategy/technique fails so proper money/risk management should always be used on every trade.

Source : https://elliottwave-forecast.com/aidans-corner/nzdusd-technical-analysis-29-march-2017