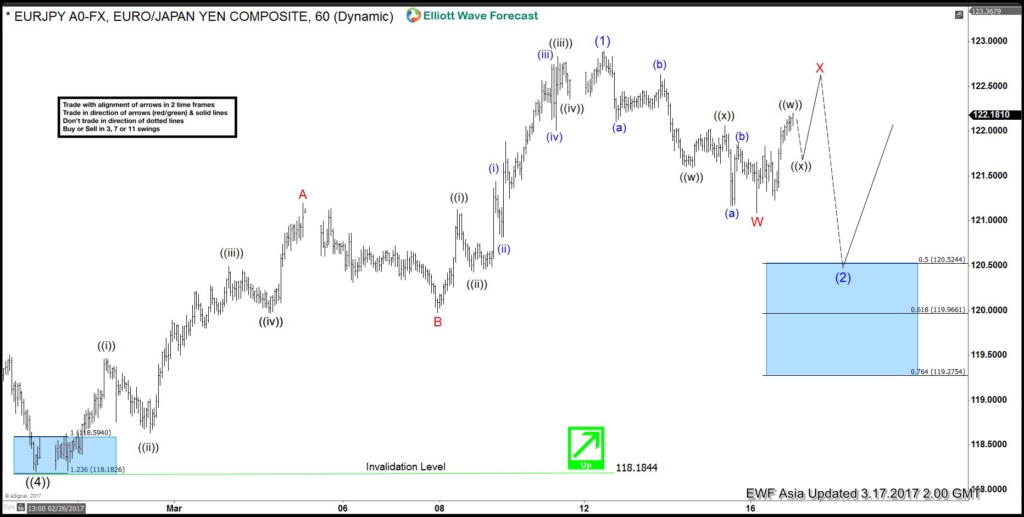

Short term Elliott Wave view in EURJPY suggests that the decline to 118.18 on 2/24 ended Primary wave ((4)). Primary wave ((5)) is currently in progress higher and the rally from Primary wave ((4)) low at 118.18 is unfolding as an ending diagonal Elliott wave structure where Intermediate wave (1) ended at 122.88. The subwaves of Intermediate wave (1) takes the form of a zigzag Elliott wave structure where Minor wave A ended at 121.19, Minor wave B ended at 119.97, and Minor wave C of (1) ended at 122.88.

Revised view suggests that Intermediate wave (2) pullback is still in progress in 7 swing or a double three structure where Minor wave W ended at 121.087. While Minor wave X bounce fails below 122.88, pair has scope to turn lower one more leg in Minor wave Y of (2) towards 119.27 – 120.52 area before the rally resumes. We don’t like selling the proposed pullback and expect buyers appear at 119.27 – 120.52 area for an extension higher or at least 3 waves bounce as far as pivot at 118.18 low stays intact. If pair breaks above 122.88 from here, that will suggest that Intermediate wave (2) has ended at 121.087 and pair has resumed the rally higher.

EURJPY 1 Hour Chart 03.17.2017

Source : https://elliottwave-forecast.com/chart-of-the-day/eurjpy-elliott-wave-correction-in-progress